Risk and Compliance Market Update – February 2024

Demand for Risk and Compliance Professionals Prevailing in Financial Services

2023 was another demanding year of change and transformation within financial services risk and compliance teams. Regulatory demands remain persistent with no signs of slowing down and given the shallow pool of candidates with in-depth experience within the different facets of risk and compliance in Australia, competition for the best talent persists.

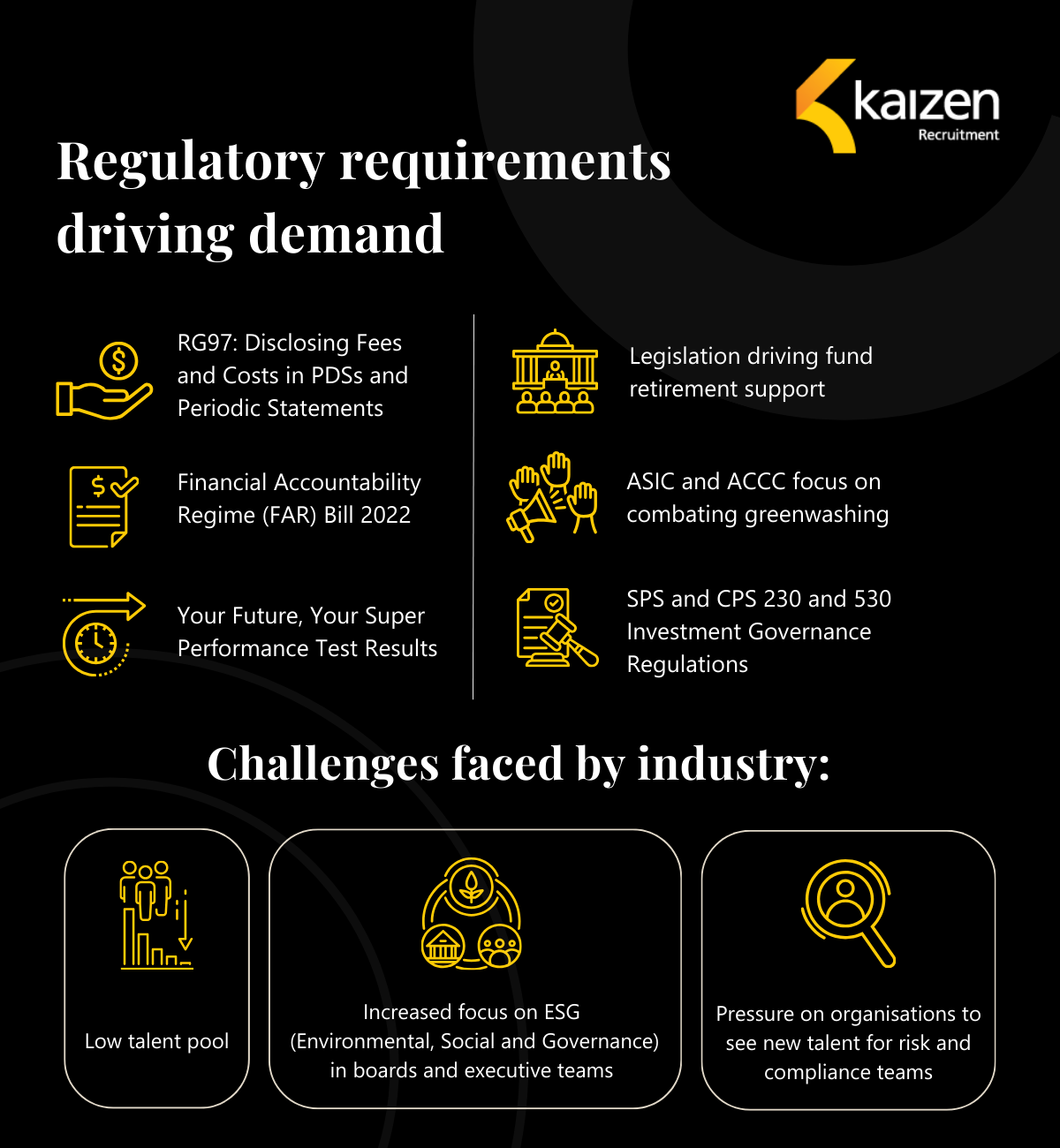

Drivers of Demand for Risk and Compliance Professionals

Demand was driven by multiple factors including the continued consolidation of superannuation funds and sustained growth in funds management, particularly alternative asset managers. Several large-scale mergers of diversified financial services businesses, trustees, and scaling fintech platform businesses have all required resourcing. Increased regulatory change and pressure from regulators to deliver these required changes with looming deadlines put pressure on risk and compliance teams all year, leaving already lean teams stretched with scaling regulatory project work.

CPS/SPS 230 steered enterprise and operational structural changes which resulted in scaling up resourcing over the past few years. We did note a few industry super funds announcing restructures across their line 2 risk and compliance teams towards the end of last year which may bring some candidates to the market in 2024.

Notably, there was also some unexpected movement at the executive and senior levels with the creation of new roles at some larger superannuation funds. This resulted in some team instability with candidates following previous managers to new firms or opting to look externally due to this change.

Staff Attrition on Risk and Compliance Teams High as Workload Levels Remain and Time to Backfill Blows Out

Qualitatively we have found that staff attrition on risk and compliance teams remains unusually high, this seems to be due to increased workloads and regulatory or enterprise structural risk project work across organisations stretching the capacity of lean teams.

This is further amplified by organisations’ internal time to hire vacant roles stretching into the 4–6-month mark.

With time to hire at an all-time high, this leaves current staff to cover the existing workloads and middle and senior management seem to be bearing the brunt of picking up the workloads in these under-resourced teams. The most concerning trend we have noticed is surrounding senior candidate burnout in firms at the end of 2023 with candidates opting to resign even without a new opportunity secured.

Candidate supply has increased overall, particularly in the Sydney market with two of the Big 4 banks and Macquarie Bank having gone through large-scale structural changes in their risk and compliance teams at the end of last year. Many of these candidates having functioned as a small cog in a much more complex banking risk and compliance system would find their siloed skill sets less desirable than others in the market.

This was amplified with AMP and Deloitte’s ongoing remediation projects wrapping around the same time releasing these wealth risk and compliance candidates who had unfortunately held often highly repetitive and administrative narrow skill sets for the past couple of years. This, combined with the fact that their salary expectations were often out of proportion having habituated their higher pay during a contract role (and now having outdated skills in comparison to peers) they found competition for roles fierce unless they were willing to forgo remuneration to renter the market in a different wealth or risk and compliance role.

The public ethical debacle observed in the Big 4 Accounting and Audit firms resulted in a critical loss of business in risk project consulting work and as a result, organisational restructure resulted in pushing candidates into the market. Others have chosen to look proactively for external positions after realising the high risk of future media attention to internal governance missteps within these firms. We see ESG risks to brands particularly incensing the Gen Z candidates at the Associate levels into the market who have been propelled by the ethics misalignment of what is an innate core value of most risk and compliance professionals. Additionally, some candidates at the Director level who may not be as enamoured with the promise of firm partnership have also been more open to external opportunities toward the end of last year. We foresee this reputational damage continuing to unbolt Big 4 candidates into 2024.

Demand vs. Supply: Niche Risk and Compliance Skill Sets

Regulatory changes across the space continue to bolster demand for risk and compliance professionals across the financial services sector as we begin this new calendar year which is likely to continue the pressure on organisations to seek new talent for their teams. The demand from organisations for resourcing remained high and spread across multiple verticals including:

Anticipated Trends Throughout 2024 in Financial Services Risk and Compliance

With demand remaining high in financial services risk and compliance, we forecast the shallow skill sets of risk and compliance professionals, particularly in superannuation and funds management, will continue into 2024 as organisations compete for niche skill sets as they all mirror the same scaling in preparation for regulatory changes impacting business. For example, LinkedIn statistics in January 2024 indicated there was a 40% increase in the creation and demand for Director-level Risk and Compliance professionals within financial services. If organisations cannot engage an external partner like Kaizen Recruitment to tap into their networks for these in-demand skills, they will likely have to reconcile with the time needed to allocate to invest in hiring and training the available surplus of candidates in lateral parts of the market from the Big 4 Banks and Audit and Accounting firms or remediation projects who may not presently possess some of these, particularly in demand niche risk and compliance skill sets.

Get in Touch

Kaizen Recruitment specialises financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. We are based in Melbourne and Sydney. If you’d like to discuss candidate career drivers and the current stats of risk and compliance within the financial services recruitment landscape, please reach out to Amanda at +61 412 123 726 or get in touch with our team below.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list