Financial Services Market Update – February 2024

Financial Services Market Update

It was a busy end to the calendar year, December 2023, with work being called in right up to Christmas Eve.

The overall sentiment in the financial services employment market is very positive, with recruitment activity remaining very strong. Some areas remain a challenge to recruit for and highly sought-after skills have continuously needed to be head-hunted.

All firms need to be clear on their point of difference Employee Value Proposition (EVP) to compete for talent, and candidates are still looking for the most optional mix of work flexibility, organisation culture, salary, career development and training.

An interesting observation during the month of December was the surprising number of senior professionals who had chosen to resign with no job to go to. It was clear many were burnt out and decided to take a prolonged break before re-entering the workforce.

Investments

Due to the internalisation of Superannuation Funds and Fund Managers trying to maintain and seek new opportunities within their portfolios, the demand for investment professionals remained strong towards the end of 2023.

We experienced a high demand for fixed income, credit, and alternative asset class experience across listed and unlisted markets.

Hiring was consistent at all levels from Analyst to Senior Portfolio Managers, with recruitment activity at the Analyst and Senior Analyst level most prevalent.

Most investment teams are still male-dominant, and the demand for female investment professionals continues.

We experienced multiple funds requesting only to hire female investment professionals, which caused delays in the recruitment timelines due to shallow pools of talent at the senior end of the market.

As most super funds continue to grow, increasingly investment positions are becoming more and more specialised, with some skills (investment strategy and asset allocation in particular) being more challenging to find. However, despite this increased demand for specialist investment skills, the more general skill set of fund manager research, typically developed in asset consulting, remained in demand for most Analyst and Senior Analyst positions.

It was interesting to observe some movement at the Chief Investment Officer (CIO) level in the market. Increasingly, a CIO’s position is seen as more leadership-focused than managing investments. The CIO is ultimately the leader of the investment team and it’s important to surround themselves with investment specialists and be the conduit to strategically bring it all together holistically rather than making individual investment decisions.

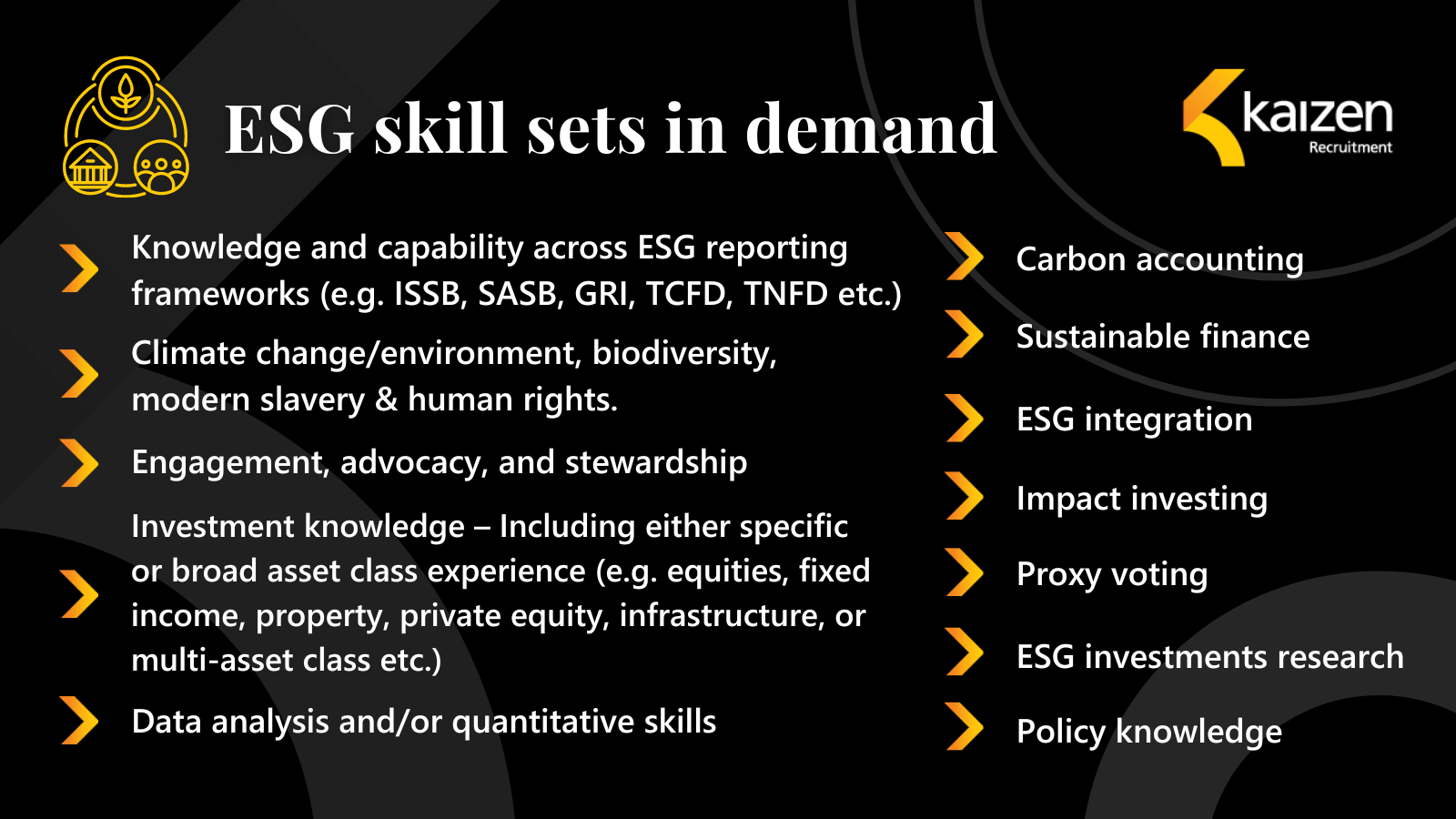

ESG and Responsible Investment

With the release of the International Sustainability Standards Board (ISSB) climate-related disclosures standard IFRS S2 in June 2023, the scene has been set for mandatory sustainability reporting to become compulsory. Initially starting with large Australian companies in June 2024 the reporting scope will expand to smaller businesses over the coming Financial Years.

We foresee this coinciding with an increased demand for ESG reporting skills as the market begins to hire skilled talent to ensure they can sufficiently cover reporting requirements. The vast impact this reporting standard will have, will be felt across all industries, creating a need to fill gaps in ESG resourcing quickly.

Talent in the ESG space at the 5-10 years’ experience level is in high demand as many have been promoted to more senior positions, which has left a gap in the market around this experience level. In seeking talent, we have seen companies calling for candidates who possess multiple skill sets for one position (e.g. investor relations, sustainability and fixed income).

Listed are the skill sets (or combinations of) that we see that continue to be in demand in 2024.

Investment Accounting

Demand for Investment Accountants continues to outstrip supply. We observed an increased allocation to alternative assets, which in turn amplified the demand for Investment Accountants with a skill set across alternative asset classes, particularly private debt, and unlisted assets. The vast amount of hiring has been at a Senior Fund Accounting level, with a high emphasis being put on end-to-end fund accounting experience.

There has been an influx of international Investment Accountants coming to Australia on Working Holiday Visas; however, many firms have been reluctant to offer contract opportunities or sponsorship. The regions we are seeing these Investment Accountants coming from are Ireland, UK, Singapore, China, and India. We are hopeful that firms will utilise sponsorship to solve their Fund Accounting resourcing needs given the dearth of talent in the local market.

Another trend we have observed is funds management organisations seeking alternative skillsets to strengthen their investment accounting capability, specifically targeting accountants coming out of the Big 4 financial services audit departments.

For 2024, there remains a shortage of qualified Investment Accountants with experience in alternatives and end-to-end expertise. We anticipate significant hiring for these key skill sets into 2024 and expect that in advance of the financial year-end, we expect to see amplified demand and hiring levels for Fund Accountants in the Australian Market.

Investment Operations

The investment operations landscape continues to evolve, with operations roles now encapsulating increasing aspects of fund servicing. We observed an increased demand for skills across fund operations, performance and data analytics, investment implementation and unit registry.

Investment operations professionals, with 2-5 years’ experience were most in demand, particularly those who have a broad skillset across investment operations.

Candidates possessing a strong data analytics & coding skillset were in in high demand, as firms seek to improve automation across their operations teams. This skillset is quite niche in the fund management space, which has resulted in some firms, looking for this skillset from other sectors such as insurance.

Investment Operations Conference

Sales and Distribution

The vast majority of hiring activity was across wholesale and retail channels and there has been a genuine emphasis on delivering diversity when hiring new sales professionals.

Experienced Business Development Managers with established client networks have been the most sought after as organisations continue to compete for a shallow pool of exceptional talent.

We have observed rapid growth in private credit funds strengthening their distribution capability and expect this trend to continue in 2024.

External market pressure on funds management organisations has proven tough to raise capital and we noted a trend where several distribution professionals unfortunately were not able to meet their targets, hence bonuses in most cases have not been as lucrative as previous years.

We have observed a shift of client focus to alternative sources of institutional capital. Some firms are pivoting to stable areas of the market such as wealth managers, family offices, insurance firms, not-for-profits and charitable trusts.

Wealth Advisory

The wealth advisory space across Australia has been dynamic and competitive with demand for qualified professionals continuing to remain strong.

Traditionally, clients have shown a preference for financial advisors who possess an established client base or “book.” However, recent market observations indicate a shift in this trend. While a significant portion of clients still value Advisers with a solid book, there is a growing openness towards professionals who possess extensive experience in the advisory space but may not have an existing client base. This change can be attributed to a recognition of the importance of expertise, skills, and knowledge in the field of wealth management.

Clients are increasingly recognising that an Adviser’s ability to provide sound financial advice and deliver successful outcomes stems from their experience, proficiency, and deep understanding of the industry. As a result, the emphasis on building long-term client relationships solely based on an existing book is gradually giving way to an appreciation for the value that experienced professionals can bring to the table.

Demand for administrative roles such as Client Services Officers and Paraplanners remains strong as new financial planning graduates seek to move directly into provisional adviser positions.

We believe that demand for Financial Advice roles will continue to remain strong in 2024 and beyond as millions of Australians are at or approaching retirement and seek out financial advice

Projects and Technology

Demand remains strong for candidates with M&A and investment data experience, alongside systems expertise such as Charles River IMS, GoldenSource, SimCorp Dimension, Blackrock Aladdin + Efront, Mercatus and Ortec Pearl. Alongside a continued need for technical professionals, e.g. Developers & Testers, with investment exposure.

While the average remuneration levels have come back down to pre-pandemic levels for candidates with differing or more generic experience, the higher level of compensation stayed the same for candidates with these relevant skill sets.

A major shift we noticed from a client’s perspective within the projects landscape was the need for professionals at all levels, e.g Project & Program managers, to be hands-on in delivery. With limited budgets compared to previous years driving this trend, professionals who were able to wear multiple hats and get into the details were strongly favoured.

From a candidate’s perspective, we noticed a shift in expectations during job searches, with fewer jobs on the market and the increasing interest rates/cost of living leading to candidates within Projects & Technology being more open to permanent and fixed-term arrangements compared to previous years, with a shift away from flexibility and towards security as drivers when searching for new opportunities.

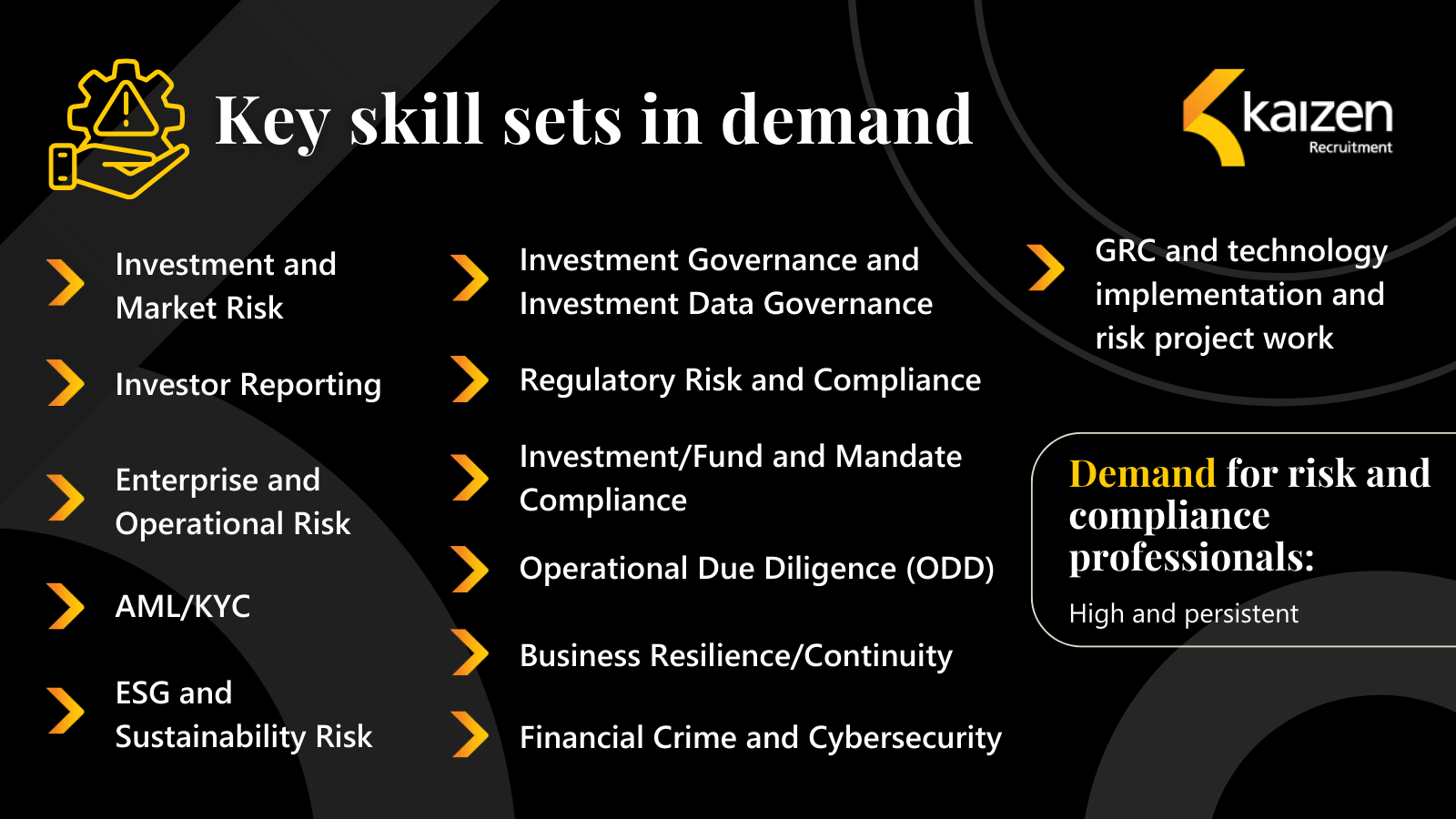

Risk and Compliance

2023 was another busy year and consistent with the previous years of change and transformation within financial services risk and compliance teams. The demand from organisations for resourcing remained high and across multiple verticals including:

Demand was driven by multiple factors including the continued consolidation of superannuation funds and sustained growth in funds management, particularly alternative asset managers. Several large-scale mergers of diversified financial services business, trustees, and scaling fintech platform businesses have all required resourcing. Increased regulatory change and pressure from regulators to deliver these required changes with looming deadlines put pressure on risk and compliance teams all year, leaving already lean teams stretched with scaling regulatory project work.

CPS/SPS 230 steered enterprise and operational structural changes which resulted in scaling up resourcing over the past few years. We did note a few industry super funds announcing restructures across their line 2 risk and compliance teams towards the end of last year which may bring some candidates to the market in 2024.

Notably there was also some unexpected movement at the executive and senior levels with the creation of new roles at some larger superannuation funds resulting in some team instability with candidates following previous managers to new firms or opting to look or externally due to this change.

Qualitatively we have found that staff attrition on risk and compliance teams remains unusually high, this seems to be due to increased workloads and regulatory or enterprise structural risk project work across organisations stretching the capacity of lean teams. This is further amplified with organisations internal time to hire vacant roles stretching into the 4–6-month mark. With time to hire at an all-time high, this leaves current staff to cover the existing workloads and middle and senior management seem to be bearing the brunt picking up the workloads in these under resourced teams. The most concerning trend we have noticed is surrounding senior candidate burnout in firms at the end of 2023 with candidates opting to resign even without a new opportunity secured.

With demand remaining high in financial services risk and compliance, we forecast the shallow skill sets of risk and compliance professionals, particularly in superannuation and funds management, will continue into 2024 as organisations compete for niche skill sets as they all mirror the same scaling in preparation for regulatory changes impacting business.

Risk and Compliance Market Update

Summary

Kaizen Recruitment has seen sustained growth of demand outstripping supply across the financial services industry, despite some signs of there being a shift in market conditions given the niche specialisations of the market continue to bring their own unique requirements and challenges from a personnel perspective.

Kaizen Recruitment specialises in financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance.

Get in touch

Kaizen Recruitment specialises financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. We are based in Melbourne and Sydney. If you’d like to discuss candidate career drivers and the current stats of the financial services recruitment landscape, please telephone our office at +61 3 9095 7157 or get in touch with our team below.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list