Investment Operations Market Update And Salary Guide

Investment operations saw a significant upward hiring trend in the second half of 2018 with the outlook for 2019 being very strong. Global and boutique fund managers are driving the demand for professionals across all seniority levels and skill sets. Demand has also been notably high for business analysts with strong funds management operational experience.

Jobs for senior operations professionals and managers also saw an upswing, especially in the final quarter of 2018 with increased job opportunities in quality assurance and controls oversight. Heightened focus on quality is being observed across firms that have outsourced their investment operations functions as well as funds managers with in-house capability.

The bulk of the demand is for mid to senior level professionals. Salaries being offered are solid and highly competitive in the market; with premiums being offered for exceptionally strong candidates.

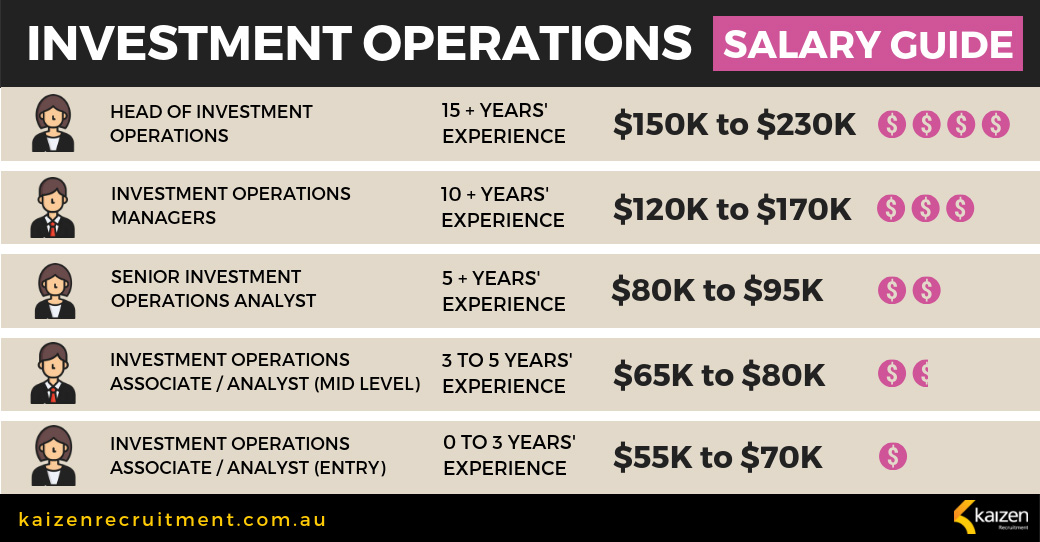

Based on Kaizen’s industry analysis, below is a salary guide for investment operations professionals. If you are considering a new career opportunity this year or looking to recruit in investment operations, business analysis, please get in touch.

Investment operations salary guide – funds management Australia

* For senior positions, salary can vary depending on the size of the team and complexity of operations (asset class coverage across products such as derivatives, systems, etc.). Bonus structures can also vary from 0-30% depending on seniority, growth phase and performance.

What do investment operations professionals do?

The gamut of investment operations functions is large. The duties that a professional may be responsible for, but not limited to:

- Trade executions and monitoring across its lifecycle: processing trades of different asset classes from when they are placed, to confirming with compliance and verifying and settling them in the market.

- Reconciling cash and stock positions.

- Processing corporate actions of domestic and international nature, such as dividends, mergers and takeovers, stock splits, spin-offs, IPOs etc.

- Liaising with custodians and third-party administrators.

- Coordinating and collaborating with other internal teams.

- Maintaining accurate investment and client data.

- Performing client reporting.

As an individual progresses, the involvement in projects, training and quality assurance increases.

What skill-sets are currently in high-demand?

- Broader operations experience across functions such as trade lifecycle, reconciliations, client reporting and liaising with stakeholders

- Control functions and quality assurance

- Corporate actions processing

- Exposure to Fixed income products

How to grow your career within investment operations given the current market

- Expose yourself to more functions within operations to avoid falling into a niche. Demand has been greater for well-rounded professionals as compared to specialists.

- Upskill your excel and systems skills as the need for automation and controls is on the rise.

What skills and qualifications do you need to be a good operations professional?

Career aspirants are expected to have tertiary qualifications in commerce, finance, economics or associated fields with a sound understanding of Australian and international financial markets. Furthermore, if you are already in operations, however within superannuation, transferability is high given function-based capability is similar.

Accuracy and timeliness is paramount within operations. Thus, a high degree of time management skills, attention to detail, in conjunction with strong stakeholder management skills and teamwork are a must.

For all your funds management recruitment needs, please contact Nupur Gill on 03 9111-0128 or nupur@kaizenrecruitment.com.au.

Best regards

Nupur

Nupur Gill – Recruitment Consultant

Kaizen Recruitment specialises financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. We are based in Melbourne and Sydney. For assistance or further information please telephone our office at +61 3 9095 7157 or submit an online form.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list