Good paraplanners in high demand and difficult to replace

An often under-valued role in wealth management, paraplanners are a strategic asset to any financial planning business and are trusted in modelling and formulating the advice documentation. Both traditional in-house paraplanners and outsourced paraplanners are high in demand and difficult to replace.

Paraplanning is the first hands-on exposure to the provision of financial advice. The primary function is to generate Statements of Advice for the financial advisors. Depending on the scale of the business a paraplanner’s duties may focus solely on the generation of Statements of Advice, or could include broader tasks within the financial planning process.

We have seen a rise in outsourced paraplanning services, perhaps stimulated by the 2014 FOFA changes which forced many businesses to review and improve their compliance operations. Due to a current shortage in suitably qualified financial advisors, many businesses are favouring internal promotion of their paraplanners rather than exposing themselves to risky hires of advisors who are unable to present compliance audits, stable employment or sufficient qualifications.

While we love supporting businesses who offer internal promotion this process is seeing many of the industry’s good paraplanners (deservingly) head into advisor roles, and naturally leaves a vacancy to fill. As a flow-through effect our observations are seeing more paraplanners leave than new paraplanners being trained.

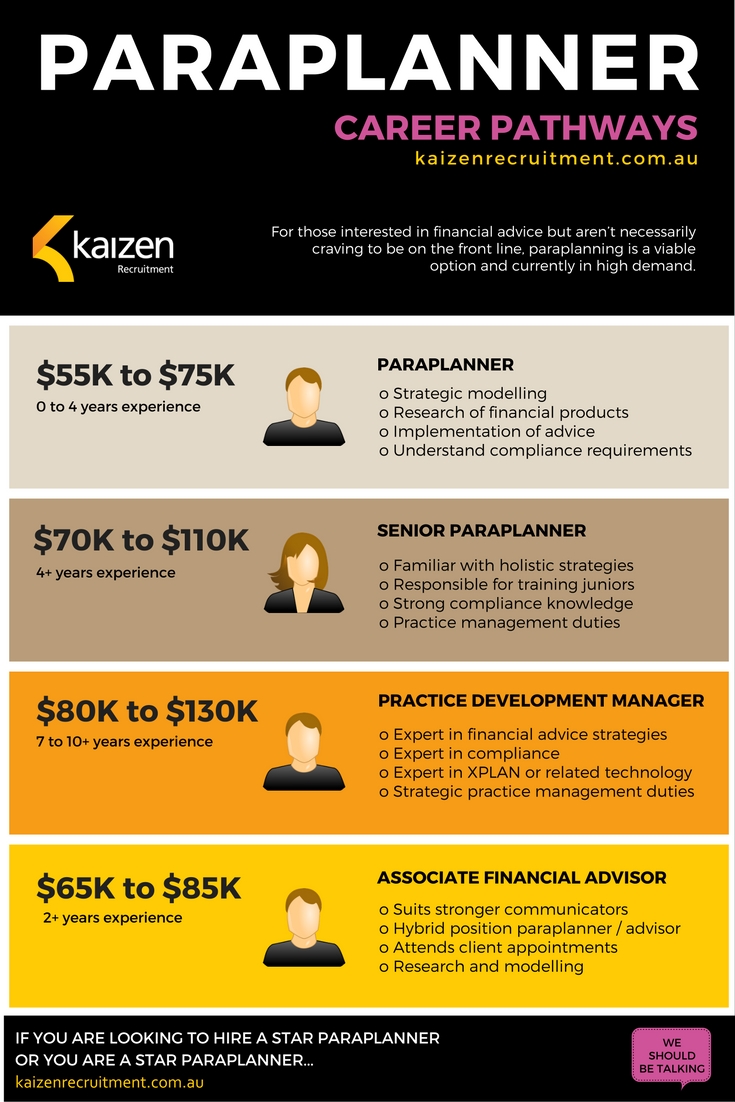

Paraplanner career pathways infographic

What do career options look like?

Paraplanner

- Strategic modelling (cash flow analysis, retirement planning, savings projections etc)

- Research of financial products including insurance, superannuation and investments

- Implementation of advice (lodging applications, performing investment switches, following up additional requirements with clients)

- Understanding compliance requirements (SIS Act, Best Interests, FOFA, Opt-In etc)

- $55k-75k package

Senior Paraplanner/ Team Leader

- Typically 4+ years in paraplanning across holistic strategies

- May be responsible for the training of less experienced staff

- Has developed strong compliance knowledge

- $70k-110k package

- Remuneration packages above $90k are available for “career paraplanners” who are typically taking on practice management and leadership duties in addition to typical paraplanning tasks.

Practice Development Manager

- Typically 7-10 years in paraplanning

- Expert in financial advice strategies and relevant compliance

- Expert in XPLAN or related planner technology

- Looks to make strategic improvements to business processes in order to improve efficiency and productivity

- $80k-130k package

Associate Financial Advisor

- Many businesses offer the attraction of “progression to advice” when hiring paraplanners. For paraplanners who have strong communication skills and desire to present advice to clients this is the most common pathway.

- Duties vary and will often be a hybrid position between paraplanner and advisor.

- Still performing most paraplanning duties however will usually be attending appointments with a senior advisor.

- In larger firms the associate advisor may be purely responsible for researching and modelling advice for their senior, and referring Statements of Advice to a paraplanning team.

- $65k-85k package

How do I become a paraplanner?

Paraplanners will typically have a client service/assistant background. Internal promotion is common and junior paraplanner roles are sometimes made available to recent graduates. RG146 is generally the minimum education standard with most businesses preferring candidates also hold relevant tertiary qualifications.

For those interested in financial advisory, but don’t necessarily crave to be on the front line, then paraplanning could be a viable option and in high demand.

Kaizen Recruitment specialises financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. We are based in Melbourne and Sydney. For assistance or further information please telephone our office at +61 3 9095 7157 or submit an online form.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list