Financial Services Quarterly Market Update – August 2023

Table of Contents

-

Financial Services Quarterly Market Update

-

Investments

-

ESG and Responsible Investments

-

Risk and Compliance

-

Investment Accounting

-

Investment Operations

-

Wealth Advisory

-

Summary

Financial Services Quarterly Market Update

It was a busy end to the financial year 30 June 2023 with demand remaining strong across our portfolio of clients in Funds Management, Superannuation, and Wealth Management.

The main observation of the quarter 1 March to 30 June 2023 was the consistent theme that demand was still exceeding quality supply for key skills. It was interesting to note that salaries had noticeably stabilised, and an increasing number of clients are now striving to compete on culture and values as well as through enhancing their broader Employee Value Proposition (EVP) offering.

For the first 4 weeks of the new financial year, we notice the market slowed considerably as recruitment budgets were finalised and are now starting to be released to the market.

While there is some caution in some parts of the financial services sector overall there appears to be positive sentiment with most of our clients indicating that recruitment activity will remain buoyant for the foreseeable future.

It is noteworthy that one of our medium-sized super fund clients currently has over 60 open positions and their Talent Acquisition team is facing challenges in managing the workload. This theme is prevalent with most of our medium-sized clients as they have a backlog of positions to recruit for. Turnover remains a challenge as key staff with highly sought-after skills has continuously been head-hunted.

We have observed pockets of redundancies and an increasing supply of candidates looking for work but struggling to catch a break. As stated, in our previous market update, we have noticed an influx of international workers with many facing challenges to have their experience recognised and navigating Australia’s complex visa restrictions.

Investments

Recruitment activity across Investments remains optimistic with the majority of our clients wanting to hire at the Senior Analyst level. This Senior Analyst demand typically focused on candidates with 3 to 6 years of relevant industry experience. We noticed an ease in salary expectations, as the majority of candidates are seeking opportunities to join teams with a strong culture, clear career development paths, and excellent leadership/mentorship.

We experienced robust demand across all asset classes, leading most of our clients to choose Kaizen as their exclusive partner due to our consistent ability to provide high-quality shortlists with equal gender representation. The persistent demand for hiring more female investment professionals, at all levels, shows no sign of slowing.

ESG and Responsible Investments

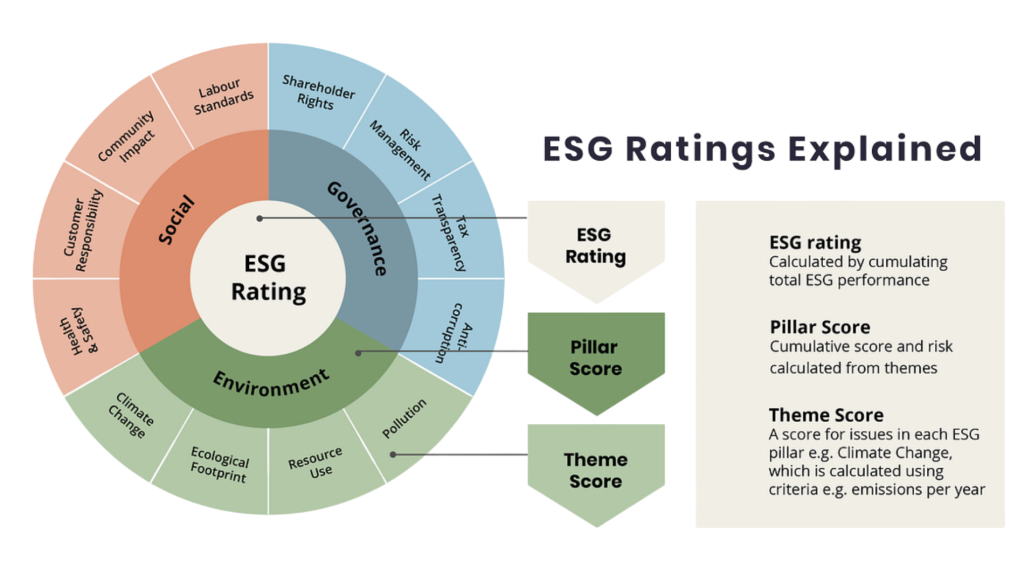

The ESG and Responsible Investment industry has experienced a busy quarter, marked by the announcement of the new Sustainable Finance Taxonomy. This development, a result of collaboration between the Australian Sustainable Finance Institute (ASFI), industry players, and the Australian Government, brings positive news that is expected to enhance clarity for numerous organisations regarding their ESG commitments and reporting standards.

Source: Czaplicki, Jan. “What Is ESG and Why Is It Important?” Medium, 5 Aug. 2019

However, amidst the industry’s growth, concerns surrounding greenwashing have emerged, causing some investors and asset managers/owners to reassess their marketing approaches to avoid regulatory scrutiny. This phenomenon, known as Greenwashing, has somewhat dampened the expansion of the ESG industry, as companies opt for a more discreet approach to their ESG initiatives, avoiding public and regulatory scrutiny.

The niche space of impact investment continues to develop. Having typically been the domain of specialised private equity firms, it is becoming more mainstream, with the likes of REST Super setting a target to achieve a 1% allocation to impact investments by 2026.

While the ESG space is preparing for further growth, it is worth noting that managers we have engaged with are still facing capacity constraints as they strive to keep up with the rapidly evolving landscape of the ESG industry.

Risk and Compliance

There has been a continued growth of risk and compliance teams within financial services organisations across multiple verticals with a continued focus on the importance of strong organisational governance.

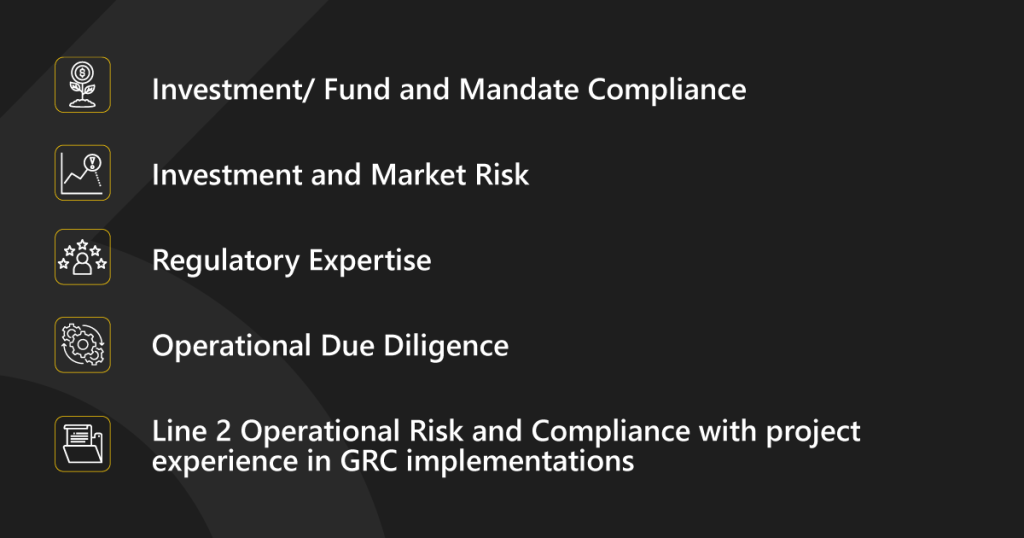

Top talent in the space remains shallow and this, combined with an increased demand for niche skill sets such as:

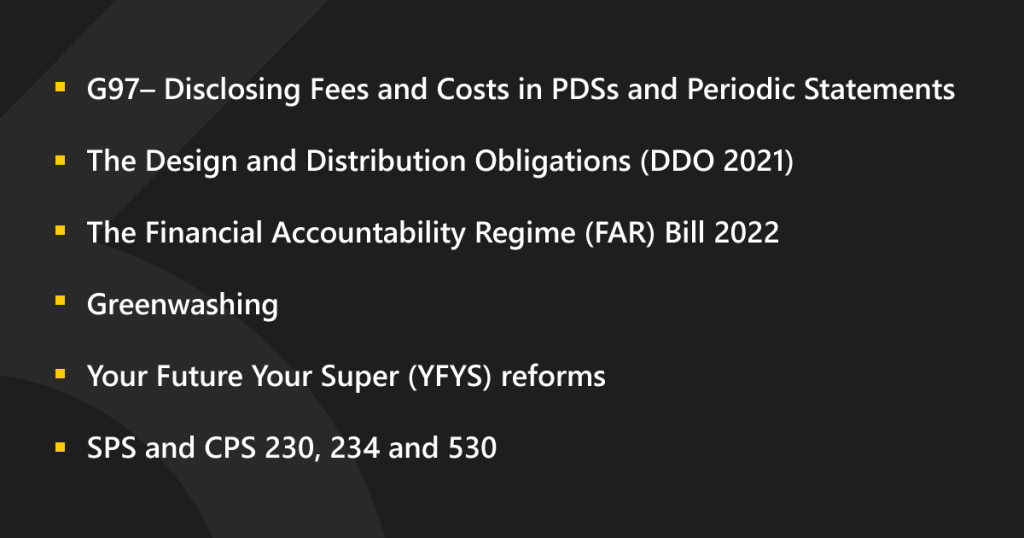

Internal regulatory project work has lifted the demand as these projects have been delegated to meet several new regulatory requirements including:

The implementation of several new regulations aimed at safeguarding consumers from misinformation has resulted in an increased demand for Investment Governance, Marketing and Communications professionals. All of these developments and regulatory changes across the space continue to bolster demand for risk and compliance professionals. Please refer to our Risk and Compliance Market Update for a more in-depth analysis and further insights.

Risk and Compliance Market Update

Investment Accounting

Investment Accountants were in high demand (year-end cycle) and it was admirable to observe that most Investment Accountant professionals we approached did not want to entertain changing jobs (despite how good the opportunity was) until their financial year commitments were fulfilled.

The market continues to experience growth and evolving trends, driven by factors such as regulatory changes, growing demand for alternative investments and the continued residual impact of outsourcing and globalisation that impacts this part of the financial services industry. There has been a noticeable rise in demand for exposure to alternative asset classes, particularly private debt and unlisted assets, specifically in the property sector.

We have experienced an influx of international investment accountants coming to Australia on working holiday visas, however many firms have been reluctant to offer contract opportunities or sponsorship. While previously for financial year ends there was always demand for contractual staff to tide through the busy periods, however, the shortage of talent available to consider contracts in the last 2 years has shrunk this area of the market considerably; with most firms retaining permanent or long-term contract staff to aid with this, or outsourcing to the accounting consulting firms who provide staff on secondments.

The demand for end-to-end investment accounting knowledge remains strong, as many funds and superannuation firms require a broad skill set to assist with the oversight model of outsourced service providers.

As funds become more complex, continue to grow, and implement transformation projects across technology and operations models, the demand for strong stakeholder management and communication skills within investment accounting has increased to facilitate cohesive operating rhythms with the investment teams and other internal and external stakeholders.

Investment Operations

Rapidly evolving operational environments are impacting investment operations teams. The market for investment operations talent has always been competitive, however with the current demand for private markets and unlisted asset class experience having increased this has been exacerbated.

As discussed by industry leaders and Kaizen at an investment operations conference in this past quarter, the better teams are put together the better the technical outcomes especially as operations teams are increasingly more integrated with risk, legal, compliance and performance teams.

There has been a debate about having generalist and specialised teams over this past year; while some funds have gone down the specialised path, others continue to see the benefit in generalist skills.

Operations roles have continued to expand to require greater skills across fund operations, performance, data, and coding, along with fund accounting and implementation in some cases. Our market observations corroborate what the funds face while the demand for breadth of these skills continues, the supply side of this wide array of knowledge and skills continues to be a challenge.

Wealth Advisory

The wealth advisory space across Australia has been dynamic and competitive with demand for qualified professionals continuing to be strong.

Traditionally, clients have shown a preference for financial advisors who possess an established client base or “book.” However, recent market observations indicate a shift in this trend. While a significant portion of clients still value Advisers with a solid book, there is a growing openness towards professionals who possess extensive experience in the advisory space but may not have an existing client base. This change can be attributed to a recognition of the importance of expertise, skills, and knowledge in the field of wealth management.

Clients are increasingly recognising that an Adviser’s ability to provide sound financial advice and deliver successful outcomes stems from their experience, proficiency, and deep understanding of the industry. As a result, the emphasis on building long-term client relationships solely based on an existing book is gradually giving way to an appreciation for the value that experienced professionals can bring to the table.

Summary

Kaizen Recruitment has seen sustained growth of demand outstripping supply across the financial services industry, despite some signs of there being a shift in market conditions given the niche specialisations of the market continue to bring their own unique requirements and challenges from a personnel perspective.

Kaizen Recruitment specialises in financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance.

For assistance or further information please contact us today.

Get in touch

Please contact me, or one of my colleagues at Kaizen Recruitment if you’d like to discuss candidate career drivers and the current stats of the financial services recruitment landscape.