Financial Advisor Salary Guide

Diminishing adviser numbers, increased client referrals, adviser experience gaps, business mergers, book purchases, compliance burden, licensee costs, business exits, and a wide array of other structural and strategic business changes have been key points raised in conversations these past 12 months.

It is not news to wealth management firms, that securing new talent, and retaining their existing is, to put lightly, a challenge. Only recently, have we seen this become much more evident.

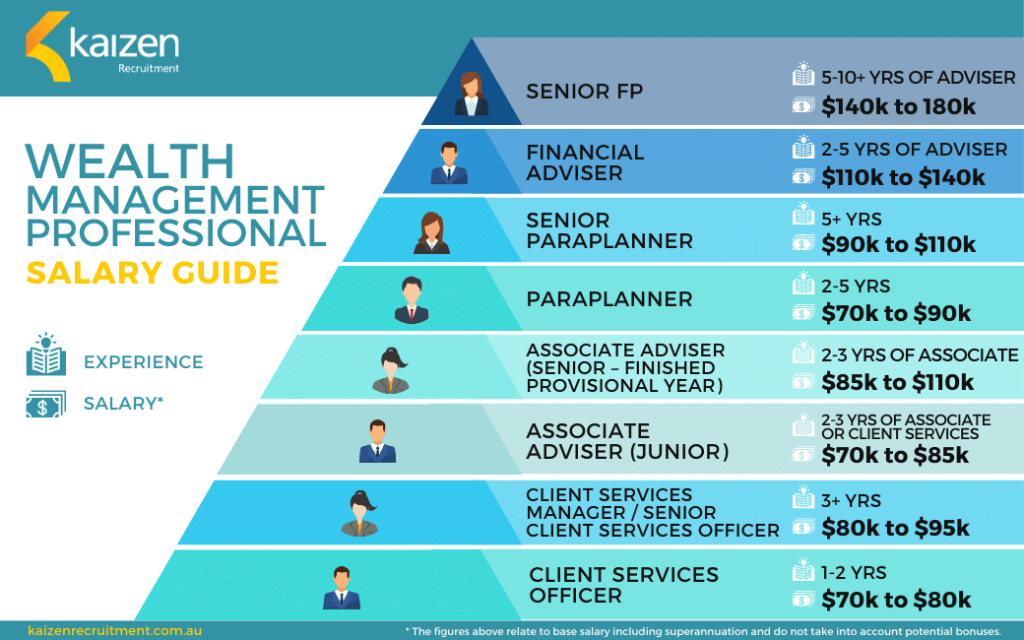

We’ve noticed salary increases. Not just CPI, nor the odd $5k here and there, but significant increases across all levels of financial advice.

There is especially strong demand for female senior financial advisers as they only make up about 10%-20% of the industry and many larger wealth management firms have diversity quotas to meet.

Salary Guide

Adviser Support – CSOs, Paraplanners and Associates

Adviser focus (for the most part) is to be in front of clients, understanding their goals and current situation then providing a solutions-based service whether that be strategic or investment. Firms with a robust support framework with implementation teams or CSOs as well as associates have a compelling value proposition for advisers to move.

However, this poses a question, how does a business secure talent at the Client Service, Paraplanning or associate level? Higher salaries, career progression framework, adequate training and new challenges are the answer.

Paraplanners are still in short supply and high demand, especially those with significant experience or who are career paraplanners. Xplan experience continues to be the forefront of requirements for client services and paraplanner positions.

Client services salaries have been increasing due to compliance increases and it is being seen as a niche and specialised admin role. Most businesses are time short and are unable to pour resources into training an incoming CSO on their preferred platform or chosen CRM to manage their client’s profiles.

Salaries and experience can blur as many candidates will have dual roles i.e. CSO/Paraplanner or Paraplanner/Associate Adviser. Generally, those candidates with broader holistic experience are more highly sought after.

Advisers

Advisers that are experienced, adequately educated (under the current guidelines), have a blemish-free compliance and have a strong track record of maintaining a significant client book remain as the epitome of wealth management firms needs and wants. Unfortunately, this pool is shrinking and advisers with 15+ years now make up a small portion of the industry. Wealth management firms are aware and are going to great lengths to keep advisers that are considering a move.

Counteroffers at the extreme end have seen a $50k bump in salary, with most being between $20-$30k.

It doesn’t stop at monetary counteroffers though, we have seen responsibility changes, title changes and other added benefits.

These advisers are left with literally no choice but to stay, especially if they have been with a firm for several years, and the risk of new unchartered waters is not outweighed by the benefits of moving.

The Next Generation

Wealth management companies need to be mindful of different generation expectations. Depending on the generation an individual was raised will depend on their career motives, goals and objectives.

Your more seasoned advisers are seeking stability and security in a workplace, whereas the newer generation are searching for personal/professional development including a professional year framework. One thing both do have in common are the need for flexibility. Seasoned advisers generally have families and value flexibility from a perspective of before/after school drop offs. The newer generation enjoy flexibility, but in a lot cases also enjoy a dynamic and vibrant office culture.

Firms who directly communicate an employee career growth plan can attract the best young talent in the current candidate-short market. Company branding and Employer Value Proposition (EVPs) has also become an important strategy for attracting the next generation.

For all client services, paraplanner and financial advisor roles, please contact Simon Gvalda at Kaizen Recruitment on 0412 122 593 or simon@kaizenrecruitment.com.au or Fiona Lu at Kaizen Recruitment on 0412 123 706 or fiona@kaizenrecruitment.com.au

Kaizen Recruitment specialises financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. We are based in Melbourne and Sydney. For assistance or further information please telephone our office at +61 3 9095 7157 or submit an online form.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list