What Makes A Good Funds Management Business Analyst – Plus Salary Guide

The demand for business analysts (BA) within funds management has significantly increased over the last 18 months. We have seen a strong pull from superannuation funds as they implement funds management systems to build out internal investment capability. In addition, some of the larger fund managers are implementing new operating models as well expanding their investment offerings and improving the systems that support investment teams.

What our clients look for

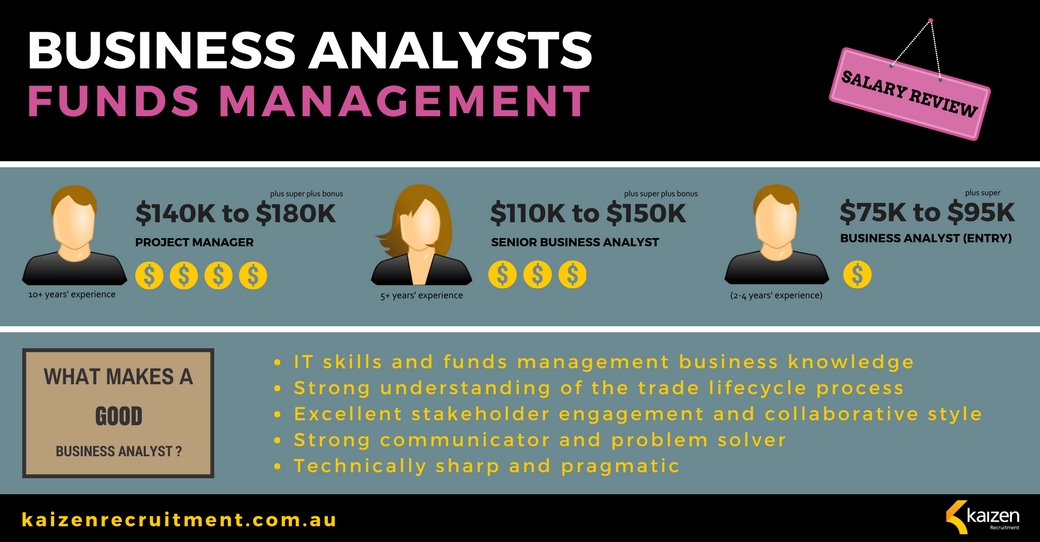

Overall our clients are after a blend of IT skills and funds management business knowledge. They want professionals who have a strong understanding of the trade lifecycle process, stakeholder engagement and how investment management systems operate. Notwithstanding good BAs are strong communicators, problem solvers, collaborators, technically sharp and pragmatic.

What asset management systems do you have exposure to?

We often see BAs get hired based on their expertise on one particular system (CRD, IRESS, Bloomberg AIM, Simcorp Dimension, Aladdin, Factset, Thinkfolio), so it is important to discuss your knowledge and experience with these systems.

In addition, you need to explain your engagement with business users from the front, middle or back office and how you worked with them to manage system enhancements or achieve project outcomes.

This is why we see a lot of our clients hiring candidates from an application support or systems analyst background for entry level BA positions.

Project exposure / Systems Development Life Cycle (SDLC)

The broader your project exposure can have a direct correlation to your perceived value and employability. Increasingly our clients are also looking for candidates with training in disciplined project methodology such as Agile and Waterfall.

You need to prepare well for interview

We have seen strong candidates on paper fail at interview because they could not answer relatively simple questions about their experience. For example:

- Tell me a time you had to work with a difficult stakeholder?

- Or ascertaining basic funds knowledge, “What’s the difference between equity and fixed income” ?

- Always remember to talk about your specific experience …”I did” as opposed to “we did”

On the flip side we have also seen our clients hire on attitude and aptitude. It should be clear at interview that you as a good BA are a natural problem solver.

Salaries

Salaries can vary widely and will fluctuate when demand exceeds a relatively small talent pool of supply. Some clients are missing out on the best candidates because they are unprepared to meet the market, with again superannuation funds paying above market for candidates.

Entry level Business Analysts $75,000 -$95,000

(2-4 years’ experience, typically moving out of operations or systems support positions)

Senior Business Analyst $110,000-$150,000

(established funds BA who has worked on a number of projects, strong stakeholder engagement and can work through most of the SDLC. Typically they are the link between business and IT/ developers)

Project Managers $170,000-$220,000K

(10 plus years Senior BA project experience. Often leading large transformation projects and managing a team of project resources)

Contract versus permanent salaries

Due to the project nature of BA work the majority of positions will be on a contract basis, with our clients typically hiring on 6, 12 and 18 month contracts at an agreed day rate.

This can vary with larger fund managers who may have established PMO and career development paths for their IT and BA teams. Typical high performing BAs who are hired on contract may be offered the opportunity to become permanent once they have demonstrated capability and align culturally with the business.

Contractor day rates can also vary widely and BAs will need to gauge the market and have some flexibility.

We have seen good BAs miss out on opportunities when they aren’t flexible on their daily rates; only to be still looking for work three months later.

Kind regards

Matt McGilton – Director, Kaizen Recruitment

If you would like further information on hiring funds management or superannuation business analysts or project managers in Sydney or Melbourne, please contact Chris Goulas and Matt McGilton at Kaizen Recruitment on + 61 3 9095 7157 or submit an online form.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list