Superannuation Job Market Update – October 2020

Kaizen Recruitment recently conducted a national survey with the majority of super funds across the country. We spoke to Heads of HR, CEO, COO, CIO, Heads of departments and Talent Acquisition leaders within small, medium, and large funds in every state in Australia.

We looked at hiring trends over the past three months (August, September, October) and asked about hiring intension for the next three months and how these super funds have adapted their business and recruitment practises to adapt to the challenges of COVID-19.

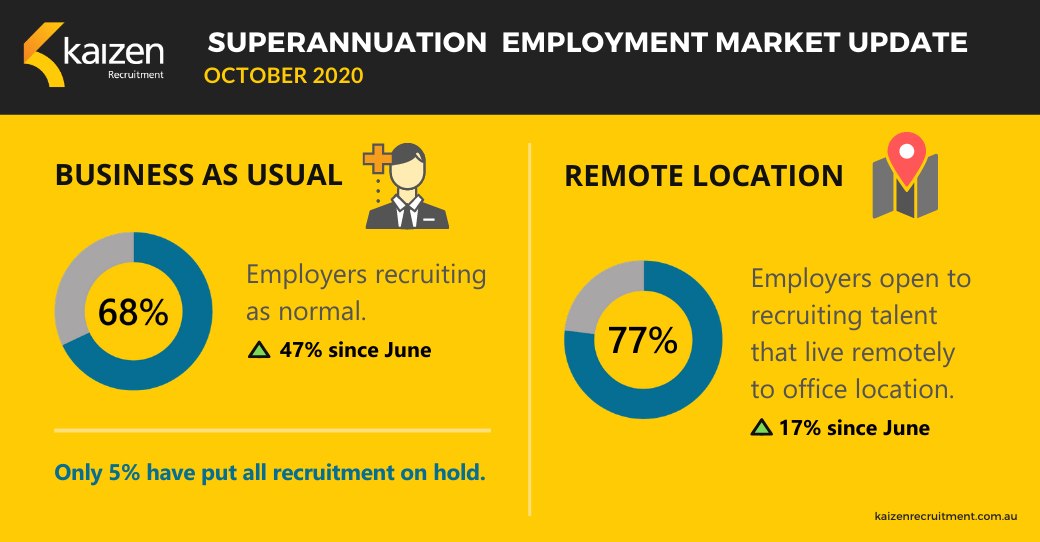

What was interesting was how all funds regardless of the size have adapted to the new reality of working from home and remote onboarding regardless of location. Less than 5% surveyed indicated that all recruitment activity has ceased during the COVID-19 period.

It is a privilege to work in an industry sector that was deemed an essential service and with the implementation of the Early Superannuation Release scheme kept all funds busy.

While recruitment in larger funds (500 plus staff) have had requirements across all areas of the business, 68% of funds surveyed indicated that there were recruiting as normal. This seemed to confirm that most participants in the industry have adapted their business to the new reality of COVID-19 working conditions (digital interviewing, remote onboarding and working from home). This is up from 21% from our survey in June, looking at the first three month of COVID-19 (March, April, May).

Recruitment patterns and requirements varied greatly based on the size of the fund, with smaller funds (less than 50 staff) been more conversative and only hiring when they were replacing essential staff due to turnover.

Across the industry there has been very few redundancies, and most redundancies have come due to mergers, namely First State Super & VicSuper and Equip & Catholic Super, mostly these were senior executives.

Some projects had been delayed or descoped with the understanding that when staff were working from home and home schooling, their productivity was significantly reduced. Now with kids back at school, working parents’ productivity has been freed up and we have seen several large projects commencing or ramping back up.

Medium (50-500 staff) and large funds (500 plus staff) typically have been better resourced and have clearly defined multi-year growth strategies. They have adapted quickly and are executing on their business strategy.

Our survey also revealed that hiring intensions of medium and large funds was a lot more proactive and are continuing with large projects including investment internalisation projects (people, systems, processes), administration systems projects and merger and integration projects.

While every fund had different recruitment needs, there certainly was some consistency as to the skills in demand, these included:

- Data professionals, and in particular investment data

- Project Manager and Business Analyst as more projects were ramping up (projects around investment & investment systems, and administration, IT, technology risk and cyber security)

- If you have acurity system skills, demand is still exceeding supply

- We have broadly seen that Risk, Compliance and Legal professionals remain in strong demand, with some risk teams doubling in size

- ESG and Responsible Investment professionals are in strong demand and again there appears to be shortage and appropriately skilled professionals

- Investment professionals remain in demand too, especially if you are an asset class specialist

The need and desire for most funds to focus on gender diversity continues to be a recruitment theme, particularly when recruiting investment professionals. Most funds we talked to are aiming to achieve 40 / 60 gender ratios in investment teams. Some are doing this better than others.

We have seen no reduction in salaries during this period, and some professionals can be surprised by the demand for their skills. The only way to truly assess your value is to put yourself on the market.

There is positive sentiment for candidates in this sector with many candidates we have worked with during the last six months receiving multiple job offers, and salary increases when they are prepared to move.

As always funds must compete and differentiate with their employment value proposition to attract and retain the best. Again, some are doing this much better than others.

Finally, working from home or hiring professionals who are based in remote location (interstate or regional areas – away from head office CBD location) is here to stay.

77% of leaders surveyed indicated they would consider recruiting professionals who live in a remote location, up from 60% three months ago. This creates a great opportunity to increase the size of talent pools to draw from but will also challenge workforce and team dynamics.

One smart, previously Melbourne based, super fund COO we surveyed is now doing his job from Ballina in beautiful northern NSW.

If only I had the foresight to relocat to Byron Bay earlier this year.

Kind regards,

Matt McGilton

Kaizen Recruitment specialises financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. We are based in Melbourne and Sydney. For assistance or further information please telephone our office at +61 3 9095 7157 or submit an online form.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list