Superannuation in the digital (robo) advice age

As superannuation funds look to innovate their services and improve member retention rates, financial planning services are a focal point of development and growth. FINSIA took the initiative to host a forum in which three industry leaders discussed their projects in the digital advice space.

Jeremy Duffield

Founder of Super Ed and funds management legend outlined the mega trends driving digital advice:

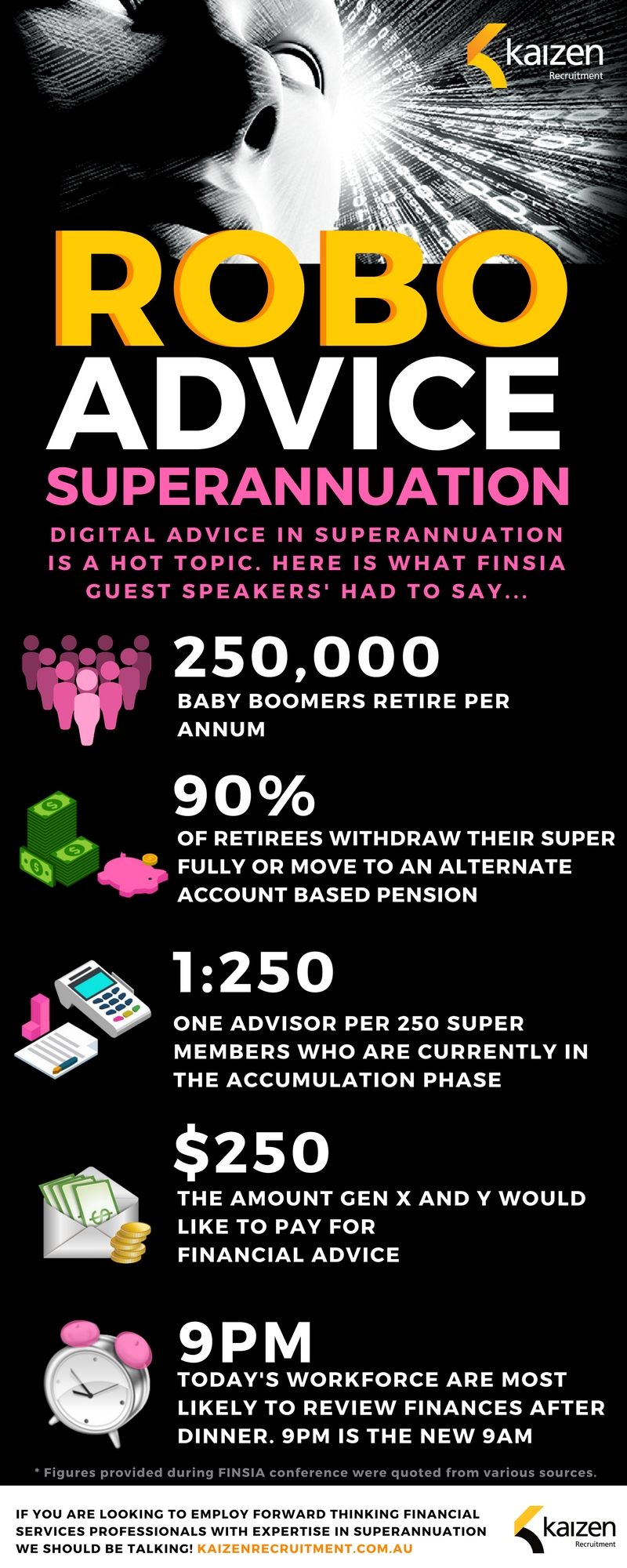

- Baby boomers are retiring in droves (approximately 250,000 per annum)

- Huge gap in advice solutions (according to sources only 15% of Australians and only 2% of industry super fund members currently receive financial advice. They aren’t engaged and aren’t saving enough)

- The rise of personalisation/customisation

- Digital disruption comes to superannuation.

Our key takeaways from Jeremy’s informative presentation:

- Member loyalty drives fund economics

- Many funds are losing up to 90% of members at retirement either through full withdrawals or rolling over to alternative account based pensions.

- SuperEd highlights ‘advice’ as the sticky point for retention.

However, the challenge is that most traditional methods of advice delivery don’t reach the mass audience. Many members are “untroubled and unaware” in their accumulation phase given their focus is toward saving for their first home, starting a family etc.

Through education, we as an industry should be increasing awareness but at the same time improving accessibility of financial advice for the mass audience. In terms of a call to action, SuperEd’s strategy is via a statement showing projected retirement income which is designed to trigger more interest and realisation that perhaps in the member’s current situation, their existing retirement plans may not get them to a comfortable retirement lifestyle.

Digital or robo-advice is an excellent entry point to provide simple advice solutions in an accessible format that more members will be likely to pursue.

Harry Chemay

Co-founder of Clover spoke about the increasing demand for automated advice and reflected on his own career as a financial advisor. He lamented the cost of traditional face-to-face advice has the perception of being too expensive and out of reach and interest of accumulators.

Constraints of traditional face-to-face advice:

- Cost of providing advice

- Focus on retirement planning

- Research shows currently there is only 1 advisor per 250 superannuation members in their accumulation phase

- Ageing workforce of established advisors, with many exiting earlier due to the lifting of professional standards. The increased education requirements have caused new financial advice professionals starting their careers later.

Current challenges:

- Massive gap between intra-fund advice and holistic advice. Harry believes digital advice can fill this gap.

- We are dealing with an unaware audience. A recent survey showed Gen X/Y stated $250 was what they felt was reasonable in terms of an advice fee

- Retirement planning typically is not front of mind for Australians under 50.

Digital advice is the ideal platform to engage members who are otherwise uninterested or unaware of the benefits in financial advice. Reasons why the lower cost platform of digital advice is disrupting traditional advice and has already experienced acceptance and growth overseas:

- We are entering Generation D… the digital natives

- Cost-conscious investors

- Preference for scaled advice

- Time poor generation

- “9pm is the new 9am” – our workforce is most likely to review their finances after business hours.

Harry concluded the future of advice is neither completely human, nor will it be completely robo, but a hybrid. Robo-advice can engage more super fund members and Generation D are ready to embrace this.

Super fund member retention is an industry wide challenge that all funds are focused on.

Robyn Petrou

CEO of Energy Super believed that super funds will need to add a mix of traditional face to face advice and digital advice, but concluded, “Robo-advice hasn’t yet been proven to retain or engaged members and the journey has just begun.”

- She believed that traditional face-to-face advice is still the best way to build trust with members, but highlighted the value of digital advice for her members where there were geographical constraints (ie members working in remote locations where it was not viable for a fund member to meet with an advisor).

From an executive decision-making perspective, the financial planning offering must be cost effective to both member and fund in order to be viable and accessible. Digital advice will form part of the advice continuum.

In closing, digital advice in superannuation is already a hot topic and we will be keeping a keen eye on this space as it rapidly evolves.

Matt

Matt McGilton – Director

Kaizen Recruitment specialises financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. We are based in Melbourne and Sydney. For assistance or further information please telephone our office at +61 3 9095 7157 or submit an online form.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list