Performance Analyst – Career Options And Salary Guide 2020

Working as a performance analyst continues to be one of the best entry-level analytical positions which can provide a pathway to a strong career within investments. Because of the wide exposure to complex financial market data and the expertise to evaluate a fund’s performance, being a performance analyst with a custodian can allow for career transitions into multiple front-office roles at superannuation funds, fund managers and investment consulting.

What do performance analysts cover in their role?

Across the custodian, superannuation and funds management sectors, performance analyst functions may include:

- Calculating the performance of funds at the security and portfolio level.

- Conducting attribution analysis on the returns to evaluate the performance against an associated benchmark, such as an index.

- Utilising different systems, such as Bloomberg, FactSet, and StatPro to compile the necessary information and data.

- Drafting a set of performance reports which are used for both internal and external reporting, typically on a monthly and quarterly basis.

- Attending and presenting performance reports at investment-wide team meetings and investment committee meetings.

Benchmarks for performance analyst salaries

Previously, Kaizen provided a brief overview of salaries and potential career options for performance, attribution and risk analyst professionals.

In Melbourne, NAB Asset Services continues to produce the vast majority of performance analysts, who have progressed into senior roles to date.

Increasingly, the larger superannuation funds are promoting internal hires and transfers from other teams to build their performance teams, allowing for cross-training and upskilling for their employees across the investment management lifecycle.

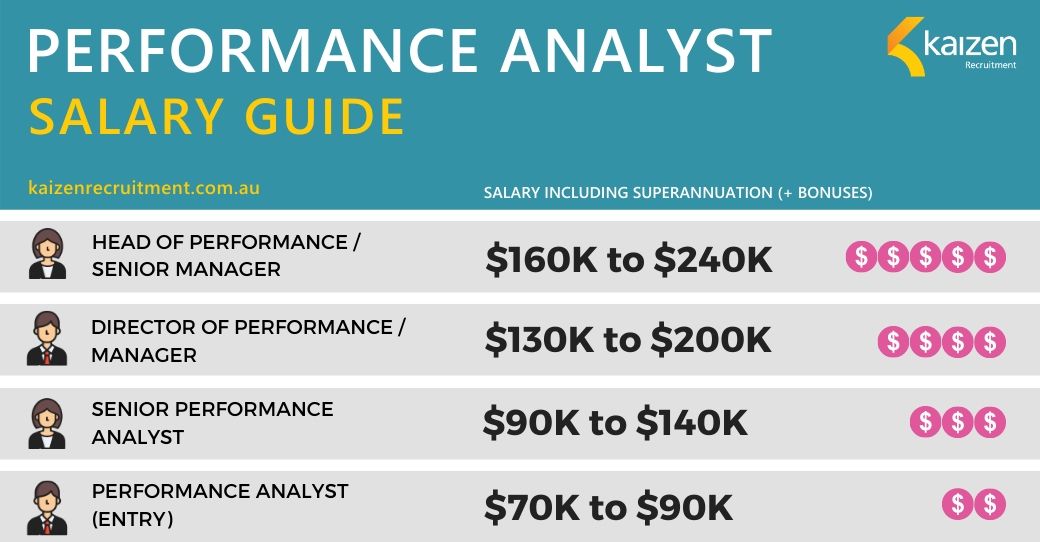

Based on Kaizen’s industry analysis, below is an updated salary guide for investment performance professionals in financial services.

These figures are based on market intel and on recent client engagements. Salaries remained fairly consistent at entry to management level, however differed significantly from management level and above. For the Sydney market, we also typically observe a 10 to 15% premium to account for the higher cost of living for similar positions across Australia. However, this can vary depending on the role and the size of the fund.

Our research incorporated additional factors and observed trends to explain the disparity across individual data points; professionals with greater responsibilities such as managing a large team and working closely with front-office teams on investment decision-making processes are compensated much higher than those with fewer responsibilities. Increasingly, apart from salary, companies are utilising their brand, reputation, flexible working arrangements and culture as a way of attracting and retaining talent.

Specific to performance analysts, factors such as internalisation of data and access to complex attribution systems also play a significant role in securing the best talent.

Whilst we have undertaken extensive research to uncover real-time data, please note that the salary ranges should be only used as a guide and would depend on the individual company, team structures, responsibilities and other factors as discussed above.

What skills and qualifications do you need that are currently in demand?

- Performance analytics experience either at a custodian, superannuation fund or at a fund manager.

- Undergraduate bachelor’s degree.

- Certificate in Investment Performance Measurement (CIPM) or the Chartered Financial Analyst (CFA) designation.

- Sound communication skills and a keen eye for detail.

- Complex systems, database (SQL) and programming (Python or similar) experience as larger funds look to hire for future workforce planning.

How do I become a performance analyst?

You will have the passion to grow and develop your career within funds management or superannuation, specifically in investment data and analytics. Numerically-savvy, organised, and the ability to communicate effectively are a must.

If you are considering a new career opportunity this year or are looking to recruit in investment performance, please contact Jewel Dcruz on +61 412 123 706 or jewel@kaizenrecruitment.com.au.

Kaizen Recruitment specialises financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. We are based in Melbourne and Sydney. For assistance or further information please telephone our office at +61 3 9095 7157 or submit an online form.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list