Risk And Compliance Salary Guide Financial Services 2022

Kaizen Recruitment’s Amanda Chisholm provides analysis and commentary on recent salary data trends within her specialisation (Risk and Compliance).

Introduction

The current Risk and Compliance market is especially buoyant, with a continued war for local talent proceeding as Australian borders remain closed. This theme is spread across financial services, including, as mentioned recently, in a broader Risk and Compliance Market Update.

Demand vs. Supply

Top talent in the space remains fairly shallow and has been increasingly competitive. Last quarter saw a continued trend of candidates receiving multiple offers at a time or counter offers from their current companies as organisations attempted to retain their top talent. This, combined with an increased demand for niche skill sets such as investment compliance, superannuation regulatory expertise, and organisations competing for high calibre senior candidates to help build and support teams through large multi-year transformations has resulted in an upward pressure on salaries.

Risk and Compliance Salary and Market Update

Risk and Compliance salaries have seen a substantial shift over the past two years due to a local talent shortage and the Australian borders being closed to all international talent as well. As fund and super fund sizes continue to grow in size, regulatory demands ever increase, and Risk and Compliance frameworks become more robust, the need for Risk and Compliance experience is essential, and clients continue to desire high calibre talent for their teams.

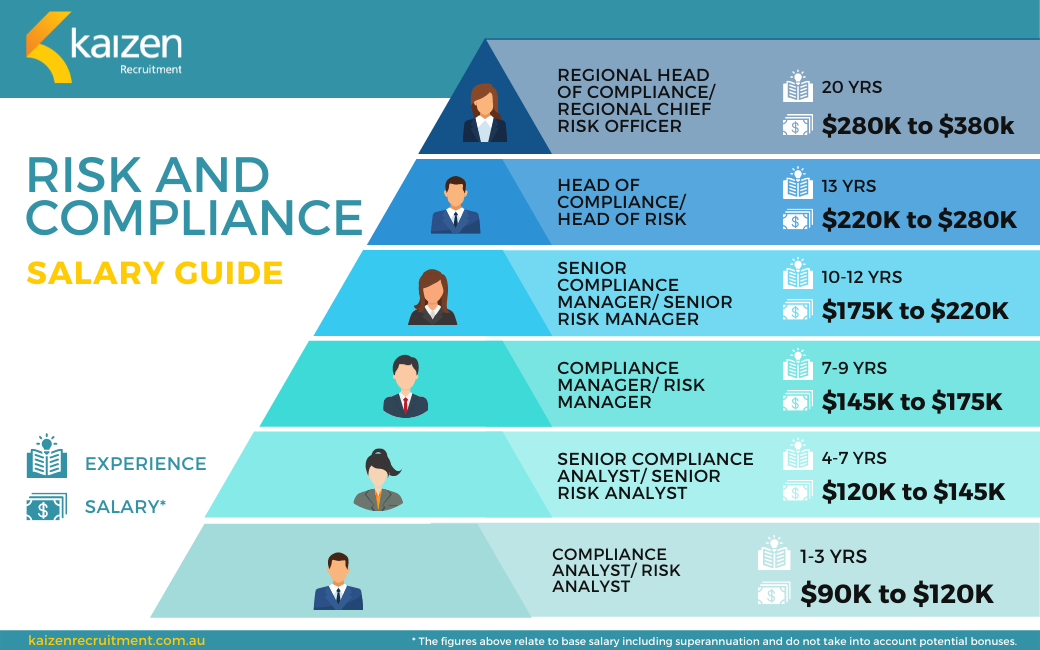

*The figures above relate to the financial services industry and reflect base salary including superannuation and do not take into account bonuses

With a lack of talent in the market, candidates are less open to taking on short-term contracts in favour of more secure and permanent options which has put serious pressure on teams as they approach regulatory reporting seasons, continue to grow in size and funds under management and undertake large scale technology and transformational uplifts throughout the business.

What do risk and compliance professionals cover in their role?

Within the financial services space, functions may include but not limited to:

- Assessing new Australian regulatory developments, communication to key business stakeholders and the integration of changes relating to the compliance and risk framework.

- Assisting in the delivery of the funds framework pertaining to compliance with prudential standards, regulatory policies and the SIS and Corporation Acts.

- Ability to interpret key superannuation legislation and proven track record in providing legal and compliance advice to a superannuation fund.

- Reviewing and preparing risk frameworks, updating relevant policies and procedures.

- Reviewing marketing materials, requests for proposals, conduct due diligence questionnaires and legal documents.

- Reviewing compliance breaches and incidents, ensuring they are appropriately reported in the funds risk register.

- Ensuring that the funds operates within the confines of their compliance plan and Part 5C of the Corporations Act.

- Advising on and taking responsibility for of the funds AFSL requirements.

Qualifications

Risk and Compliance candidates are expected to hold tertiary qualifications in finance, law, commerce, accounting or related fields. While a traditional pathway in risk and compliance often stemmed from a career in audit, we are noticing many organisations are increasingly open to candidates who come from engineering backgrounds given the innovative and uniquely analytical perspective provided from this discipline.

Sound communication skills and strong attention to detail are a must have, particularly in compliance and audit roles. Risk and Compliance experience, either at an Australian regulator, superannuation fund, fund manager or reputable consultancy firm are also necessary to secure a role within financial services.

Increasingly we are seeing requests for additional risk, compliance, and governance certifications from the Governance Institute of Australia (GIA) or from Certified Practising Risk Manager (CPRM) – Risk Management Institution of Australia. Certification in RG146- Superannuation is also increasingly being required for roles within the superannuation industry.

Conclusion

With a shortage of talent in the market, candidates who hold a Bachelor’s degree and qualifications from the GIA or CPRM and/or RG146 in superannuation continue to outperform their peers in securing roles in the space.

Recruiting for Risk and Compliance positions at the 1-3 years’ experience level has been the most challenging, due to the retracted graduate talent pool coming from the Big4 and a complete loss of international talent arriving in Australia and searching for their first local position in the market. This has resulted in the largest salary increase since the Royal Commission with candidates taking a whopping 66% leap from a previous entry level salary of $60K to now entering the market last quarter at $90K.

At the top end of the market, candidates in a Head of Risk/Head of Compliance position with approximately 13 years of industry experience are earning between $220-280K. This is another strong increase from an initial post Royal Haynes Commission environment which saw candidates previously earning between $200-250K. The exception to this trend has been the added request for Heads of Risk and Compliance to possess and additional strength of knowledge in investments as well which has pushed salaries well above the $300K range in that niche part of the market.

As organisations remain focused on building more mature risk and compliance frameworks, and funds continue to grow and scale in size, the demand for high quality talent continues to trend into 2022 with no signs of slowing down.

Kaizen Recruitment specialises financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. We are based in Melbourne and Sydney. For assistance or further information please telephone our office at +61 3 9095 7157 or submit an online form.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list