Funds Distribution Salary Guide and Trends FY 25-26

Download the Salary Guide

Our latest insights into Australia’s funds management distribution landscape are drawn from a comprehensive salary survey conducted earlier this year, capturing perspectives from distribution professionals nationwide.

These findings have been enriched by cross-referencing with our extensive industry database and informed by in-depth discussions with candidates and clients, ensuring a well-rounded view of salary trends, market dynamics, and evolving skill demands.

This guide explores key movements across retail, wholesale, and institutional channels, offering a snapshot of salary trends, emerging roles, and what both candidates and clients are prioritising in today’s market.

For a more extensive discussion on salary, bonus, and additional benefits, fill out the form to download the salary guide.

Funds Distribution as a Cornerstone

Distribution remains a cornerstone of Australia’s funds management industry, serving as the backbone of client relationships and business growth. In a fast-moving market shaped by volatile market conditions, evolving investor behaviour, intensifying regulatory scrutiny and advancing technology, long-term success demands more than traditional networks. Today’s distribution professionals must have deep product expertise, excel in consultative selling, and deliver measurable value in a fast-moving market. As the industry evolves, those who blend relationship-building with product expertise and strategic insight are best positioned to thrive in an increasingly complex and competitive landscape.

- Market Overview: Trends Shaping Distribution

- Key Drivers of Team Growth and Movement

- Motivators for Career Moves

- Recruitment Trends in Distribution

Market Overview: Trends Shaping Distribution

Retail Distribution

Retail has been reshaped by the ongoing drop in financial adviser numbers – now sitting below 16,000 nationwide. With fewer advisers in play, we’re seeing a strong move toward direct-to-consumer strategies, especially targeting high-net-worth (HNW) investors, favouring the wholesale distribution landscape.

ETFs continue to dominate, offering investors low-cost ways to ride out market volatility. Advisers are leaning into ETFs and managed accounts for broad exposure and risk control, with passive strategies gaining traction in uncertain times.

Fee pressure is still a big theme. Traditional unit trusts are feeling the squeeze, and investors are clearly favouring transparent, low-cost options like ETFs and managed accounts. Fund managers are being pushed to rethink pricing and sharpen the value they deliver.

Wholesale Distribution

Wholesale is growing, thanks in part to the eligibility criteria for wholesale investors, opening the door to more investors. Managed accounts and private credit are gaining momentum, with demand for tailored, outcome-driven solutions on the rise. Wholesale business development managers (BDMs) are hot property, especially those with strong networks and a consultative approach.

Third-party distributors are also stepping up, as global managers hit pause on local expansion due to high costs. That’s creating space for Australian-based distributors to connect international products with local investors.

Private credit is booming in wholesale, targeting family offices, HNW/UHNW investors, and private wealth managers. The catch is: very few of these funds have Lonsec or Zenith ratings, and without them, raising capital is proving to be tough.

Institutional Distribution

Institutional distribution is in the middle of a shake-up. Super fund mergers – driven by cost and performance pressures under the Your Future, Your Super rules, are changing the game. Regulators like ASIC and APRA are dialing up scrutiny on private-market valuations, pushing managers to be more transparent and tighten up risk frameworks.

Super funds are increasingly insourcing mandates, which means fewer opportunities for external managers. That is prompting a pivot toward wholesale and retail channels, where things are more dynamic. Asset and wealth consultants remain key gatekeepers in this space overall.

Key Drivers of Team Growth and Movement

Client Channels

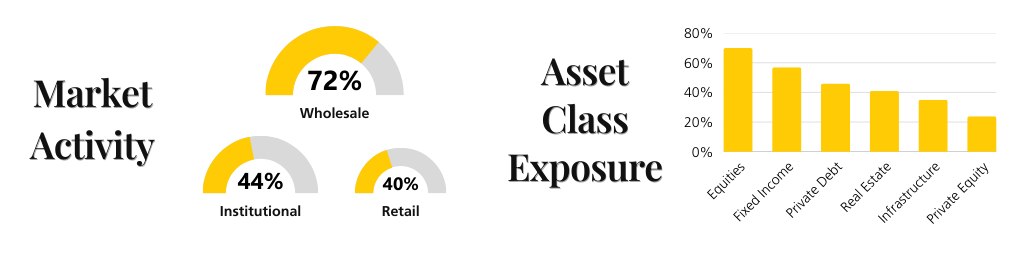

Many distribution professionals work across multiple channels, so the figures reflect their active involvement rather than exclusive segmentation, providing insight into the interconnected nature of funds distribution.

Wholesale distribution remains the dominant force in the funds management landscape, accounting for approximately (72%) of market activity. Institutional (44%) and retail (40%) channels also hold substantial market share, though the most active hiring and expansion efforts are concentrated in wholesale. This trend reflects a strategic emphasis on servicing wealth management groups and family offices, which are key drivers of growth in the sector. Consequently, wholesale teams are scaling up to meet demand, while institutional teams tend to remain lean and highly specialised – often with just a few individuals covering the entire market.

Investment Product Trends

Equities (70%) and fixed income (57%) remain the dominant asset classes across all channels, consistent with their foundational role in portfolio construction. However, these strategies face increasing pressure to deliver strong performance and differentiation, especially as asset owners continue to manage them in-house and passive investment options gain traction.

Real estate (40.5%) and infrastructure (35%) maintain solid interest, offering tangible assets with long-term growth potential. Notably, private debt (46%) has seen a significant rise in popularity, indicating a growing appetite for alternative investments. Private equity (24%) remains a niche but relevant option for diversification.

While only 24% of respondents cited access to a superior asset class as a primary motivator for changing roles, this may reflect a deeper trend. Despite challenging market conditions, professionals appear committed to their areas of specialisation, yet there is a clear desire for access to stronger, more resilient products within those asset classes. This underscores the importance of product quality and differentiation in career decisions and distribution strategy.

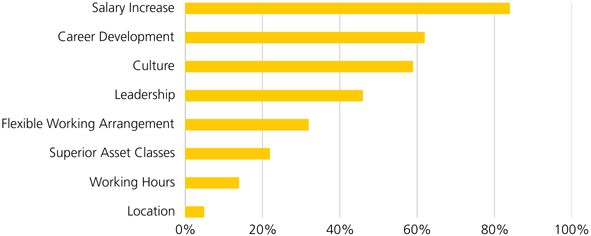

Motivators for Career Moves

Role of Product Quality and Specialisation

While salary, career development, and culture remain the top motivators for professionals considering a role change, the survey revealed a surprisingly modest response rate (22%) for superior asset class as a driver.

This is particularly notable given the current market conditions, which have made capital raising increasingly challenging for BDMs. One might have expected a stronger push toward roles offering access to higher-performing or more resilient products. However, the data suggests that many professionals prefer to remain within the asset class they’ve built expertise in, even if they are quietly seeking stronger product offerings within that category. This reflects a nuanced balance between specialisation and the desire for better tools to succeed in a tough fundraising environment.

Work Flexibility and Value-Driven Priorities

Interestingly, 32% of individuals indicated flexible working arrangements as a key motivator. When taking into account the number of distribution professionals who must be in the office for 5 (27.2%) and 4 (24.5%) days a week, it is likely to assume that more than half those professionals would favour and seek opportunities that are able to offer more flexibility.

Overall, the data highlights a shift towards value-driven career decisions, where compensation, development, and culture outweigh traditional considerations like commute or schedule.

Recruitment Trends in Distribution

Hiring Activity Across Channels

Retail distribution hiring has cooled, thanks to market volatility, the rise of asset consultants, and the dominance of managed accounts. Regulatory changes have made things trickier for advisers, and while strong networks still matter, they’re no longer enough on their own. This has opened the door for newer, driven talent to break in. Unless a fund is really outperforming, raising capital is tough.

In wholesale, recruitment has been most consistent – especially in private debt. Like retail, networks matter, but the broader investor base means that motivated, strategic newcomers can still thrive.

Institutional recruitment is quieter, with super fund consolidation and fewer external mandates. Some institutional BDMs are now exploring wholesale or asset consulting roles to stay in the game.

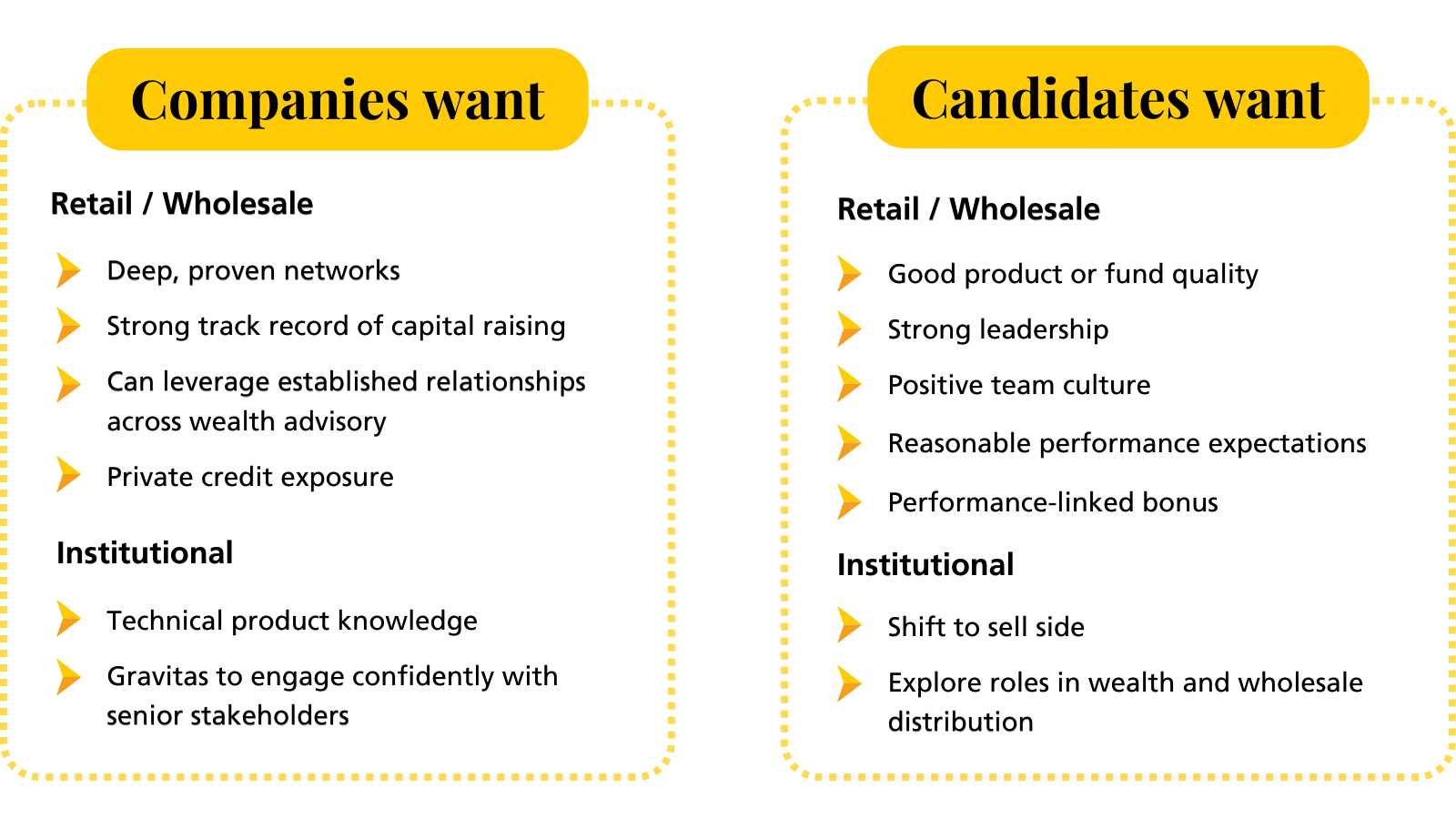

Employer Priorities in Candidate Selection

In the current funds management landscape, hiring trends vary significantly between retail/wholesale and institutional distribution. In the retail and wholesale space, nearly all recruitment over the past year has focused on candidates with deep, proven networks and a strong track record of capital raising. Given the challenging market conditions, firms are prioritising individuals who can leverage established relationships across the wealth advisory market, including platforms and research houses, to drive distribution outcomes.

Private credit remains a standout asset class, and candidates with experience in this area are particularly sought after. Conversely, recruitment in the institutional space has been far more limited, predominantly due to market consolidation, fee compression and regulatory scrutiny.

When hiring does occur, firms are looking for professionals with strong technical product knowledge and the gravitas to engage effectively with senior stakeholders. Unlike the wholesale market, existing relationships are less critical; instead, the ability to communicate complex strategies with credibility and depth is key.

Candidate Expectations from Employers

Candidates in the funds management distribution space are becoming increasingly selective about their next move, with priorities shaped by both market conditions and career aspirations.

In the retail and wholesale channels, the most important factors are:

- the quality of the fund or product;

- strong leadership;

- positive team culture; and

- reasonable performance expectations.

Many candidates are coming from roles where targets have been misaligned with the realities of a tough capital-raising environment, and they’re now seeking firms that offer support, clarity, and achievable goals. Career progression and the ability to earn a consistent, performance-linked bonus remain top motivators.

On the institutional side, opportunities are more limited, prompting many candidates to weigh up a shift to the sell side, or explore roles in wealth and wholesale distribution. However, transitioning into these channels can be challenging, as institutional BDMs often command inflated salaries and may lack the networks required by hiring firms in the wholesale space. Despite this, institutional candidates are typically valued for their technical product knowledge and ability to engage senior stakeholders with credibility.

Conclusion

Financial year 2025-2026 is all about agility and innovation in distribution. Whether it’s through digital engagement, evolving products, or strategic pivots, fund managers and distribution professionals need to stay sharp. Relationships and networks still count, but long-term success is increasingly about consultative selling, deep technical knowledge of products, and delivering real value in a fast-moving market. For all funds management distribution roles, please get in touch with Riley Thompson below.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list