Financial Advisor Salary Guide Australia

Financial advisor bonuses

There has been a shift away from revenue-only linked bonuses to a balanced scorecard method which involves advisors being assessed on both financial and non-financial performance metrics which is likely to include compliance ratings, teamwork, new revenue, client satisfaction and client retention. The change in bonus structure is attributed to the Royal Commission as firms are ensuring the clients are serviced in a compliant manner mitigating risk to the firm to ensure they don’t come under ASIC’s radar.

The next generation

Wealth management companies need to be mindful of different generation expectations. Depending on the generation an individual was raised will depend on their career motives, goals and objectives. Baby boomers are more likely to look for stability and security in a workplace, whereas millennials are searching for work-life balance and personal/professional development.

Firms who have and directly communicate an employee career growth plan can attract the best young talent in the current candidate-short market. Company branding has also become an important strategy for attracting the next generation, with prospective Generation Y (Millennial) and Generation Z candidates searching a company and its employees’ online media Generation Y (Millennial) and Generation Z candidates searching a company and its employees’ online media presence to ensure they act in a social and ethical way.

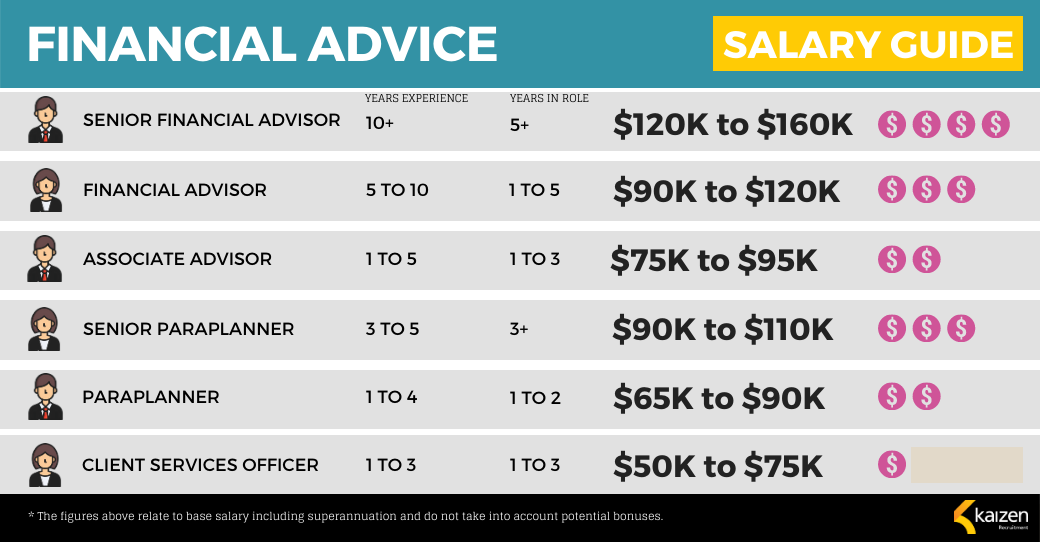

Benchmark salary for wealth management professionals in Melbourne and Sydney

What qualifications and skills are firms looking for in a wealth management professional?

Career aspirants are expected to have tertiary qualifications in financial planning or a related degree with a sound understanding of investment markets, superannuation and tax legislation within Australian. Candidates who hold their Certified Financial Planner (CFP) certification or have completed their Master of Financial Planning as in high demand as this can show long term commitment to the industry.

Xplan experience is also highly desired especially for client services and paraplanner positions as outlined in our paraplanner salary guide.

Rapport building and effective communication are still the most desired skills for financial advisors. Firms are also seeking financial advisors whom have a track record of growing and managing a fee for service client book whilst maintaining a A-grade compliance rating. Candidates who hold their Certified Financial Planner (CFP) certification or have completed their Master of Financial Planning are in high demand as this can show long term commitment to the industry.

For all client services, paraplanner and financial advisor roles, please contact Simon Gvalda at Kaizen Recruitment on 0412 122 593 or simon@kaizenrecruitment.com.au.

Kaizen Recruitment specialises financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. We are based in Melbourne and Sydney. For assistance or further information please telephone our office at +61 3 9095 7157 or submit an online form.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list