Member Services and Education in Superannuation Salary Guide 2025

In today’s superannuation landscape, Member Services and Education teams are no longer just handling inquiries—they’re the voice of the fund, the educators, and often the first touchpoint for financial wellbeing.

With a stronger focus on member outcomes, compliance clarity, and genuine engagement, these professionals are playing a more strategic role across the industry. So, what’s happening in the market—and what are these roles worth in 2025?

🔍 Top 4 Trends Shaping the Market

1. Growing Demand for Member-Centric Talent

• Empathy and clarity are critical, as members want to be heard and guided, especially during key life events like retirement, redundancy, or hardship;

• Professionals who can clarify superannuation and explain complex topics in plain language are in high demand; AND

• Funds are prioritising those with in-depth product and legislative knowledge, who can personalise advice within regulatory boundaries.

2. Digital Tools Are Enhancing Reach—Not Replacing People

• Webinars, live chat, and AI tools (such as AI-powered chatbots, virtual assistants, and AI-enhanced CRMs like Salesforce) are improving accessibility and efficiency — particularly for first-line enquiries, member engagement, retention campaigns, and claims triage;

• However, personalised support via phone and email is still the preferred channel for high-stakes or sensitive conversations.

3. Outcomes-Driven Service = Higher Satisfaction and Retention

• Teams are being assessed on member outcomes: engagement levels, fund consolidation, contribution increases, and retirement preparedness;

• Funds are linking member education efforts to broader strategic goals, such as retention and improved financial wellbeing; AND

• As a result, we’re seeing a rise in cross-functional collaboration, with Member Services working more closely with marketing, advice, and digital teams to deliver integrated service experiences.

4. Inhouse/Outsourcing + Mergers

• As more funds consider insourcing their contact centres and education functions, demand for experienced internal teams is rising;

• Others are outsourcing components to administrators, creating shifts in responsibilities and expectations; AND

• With ongoing mergers, teams are navigating system integrations, cultural alignment, and evolving service models—placing a premium on adaptable, change-ready talent.

What are candidates looking for? Professionals in Member Services and Education are driven by more than salary—they’re seeking roles where they feel supported, challenged, and valued. While priorities aren’t strictly ranked, these four areas consistently emerge as key drivers:

1. Flexibility That Feels Genuine

Hybrid remains the gold standard, but what “flexible” means varies. Most funds offer 2–3 days in the office, with some fully remote options depending on systems and role seniority. A small number of organisations still expect 5 days in office—these are becoming harder to recruit for, especially in metro areas. Flexibility also extends to start/finish times, school-friendly hours, and the ability to manage work around life.

2. Training and Development Opportunities

Professionals want more than onboarding—they’re looking for long-term development. Structured pathways into advice, compliance, or operations are increasingly attractive. Upskilling through RG146, customer experience programs, or digital tools training (e.g., CRM, webinar platforms) is highly valued, and teams that embed regular coaching and learning opportunities tend to retain top performers.

3. Supportive and Accessible Management

People want leaders who show up—not just to delegate, but to support.

• Candidates consistently cite strong leadership as a reason they stay (or leave);

• Coaching-style managers who offer regular feedback, career guidance, and genuine care are in demand; AND

• Psychological safety, inclusion, and recognition are no longer “nice-to-haves”—they’re expected.

4. Streamlined and Transparent Recruitment

Lengthy or unclear hiring processes are costing employers good people. Candidates disengage when timeframes are vague, interviewers are misaligned, or next steps aren’t communicated.

One candidate recently attended two interviews for a Member Services role and heard nothing for over four weeks. Without updates, they assumed they were unsuccessful and accepted another offer.

When feedback finally arrived — revealing they had been the preferred candidate — it was too late; the opportunity (and their interest) was lost.

What are employers looking for? With increasing focus on member outcomes, compliance, and digital engagement, employers are looking for more than call-handling experience.

1. Strong Understanding of Superannuation

Candidates who can confidently explain contributions, preservation age, insurance, and fund performance; Experience within a Fund Administration, or directly within a Superannuation Fund.

2. Technology Comfort and Digital Confidence

Familiarity with CRMs, contact centre systems, and tools like MS Office is a plus; An added bonus if they can facilitate or support webinars and digital education sessions.

3. Communication That Connects

It’s not just what you say—it’s how you say it. Employers want people who can adapt tone and language across phone, email, and online settings.

4. Compliance Awareness

Understanding regulatory boundaries and escalation protocols is a growing focus, especially with the evolving advice landscape.

5. Member Outcome Focus

Can the candidate see the bigger picture? Employers favour those who ask: “Did this help the member make an informed decision?”

Common Gaps We See in Candidates:

- Confidence with compliance-related conversations;

- Ability to tailor language based on member needs and financial literacy levels; AND

- Articulating contributions to team KPIs and member outcomes in interviews.

Fund vs Fund Admin – What’s Different?

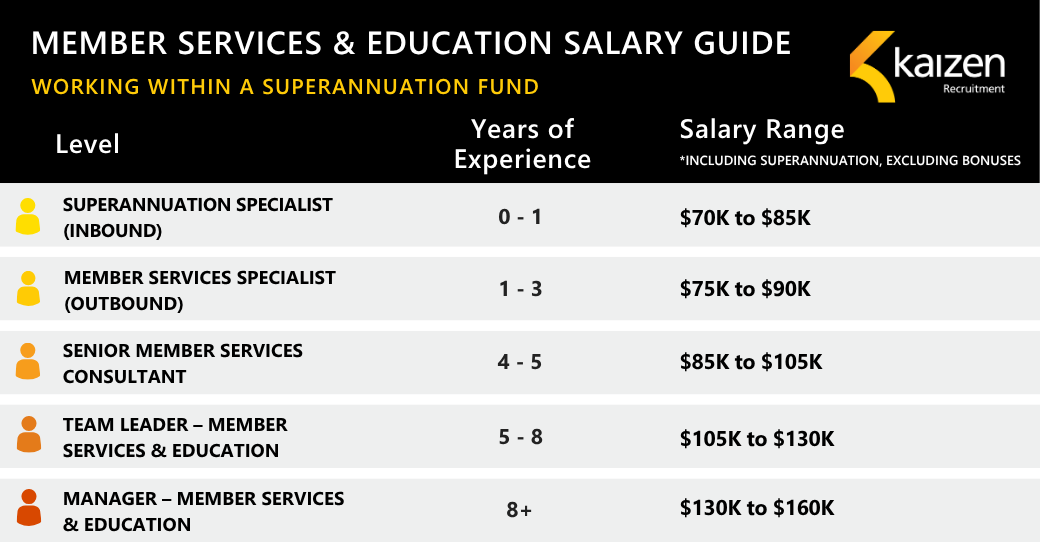

Superannuation Funds

tend to prioritise deeper member knowledge, soft skills, and values alignment.

*The figures above relate to the financial services industry and reflect base salary including superannuation and do not take into account bonuses.

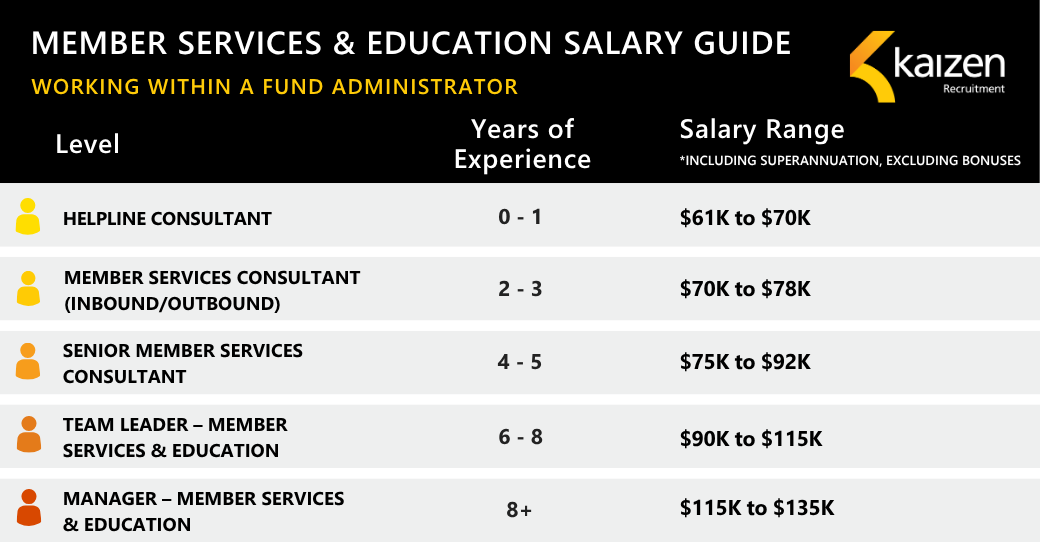

Fund Administrators

often look for volume experience, high attention to detail, and comfort with structured processes. Admin environments may also place more emphasis on SLA turnaround times and email-based communication.

*The figures above relate to the financial services industry and reflect base salary including superannuation and do not take into account bonuses.

Conclusion

Member Services and Education roles are evolving—from answering questions to truly empowering members. In 2025, success lies in combining empathy, superannuation knowledge, and digital confidence.

For candidates, flexibility, growth, and strong leadership matter. For employers, it’s about finding talent who can connect, educate, and deliver real member outcomes.

This space is no longer just operational—it’s strategic, impactful, and essential.

DOWNLOAD SALARY GUIDE AS PDF

Get in Touch

Based in Melbourne and Sydney, Kaizen Recruitment specialises in financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. If you’d like to discuss candidate career drivers and the current state of the market within the financial services recruitment landscape, feel free to reach out to us with your details below.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list